IBDP Economics SL – Macroeconomics – Variations in economic activity—aggregate demand and aggregate supply -Paper 2 Exam Style Practice Questions

Variations in economic activity—aggregate demand and aggregate supply Paper 2?

Exam Style Questions..

Subject Guide IBDP Economic IBO

IBDP Economic SL- All Topics

Exam Style Question for Variations in economic activity—aggregate demand and aggregate supply -Paper 2

Burundi

- Burundi is a small landlocked African country. Densely populated, it has a population of approximately 10.6 million inhabitants. The economy is dominated by subsistence agriculture, which employs 90 % of the population, though cultivatable land is extremely scarce. More than a decade of conflict led to the destruction of much of the country’s physical, social and human capital. However, substantial improvements have occurred since the conflict ended in 2006, thanks largely to the success of measures implemented to reduce the excessive control of the military.

- Even though Burundi is enjoying its first decade of sustained economic growth, poverty remains widespread. Burundi’s ranking on the Human Development Index (HDI) increased by 2.5 % per year between 2005 and 2013 as education and health outcomes have significantly improved over the period, yet the country still ranks low at 180th out of 187 countries in 2013. Per capita gross national income more than doubled between 2005 (US$130) and 2013 (US$280).

- Burundi is making the transition from a post-conflict economy to a stable and growing economy. Economic reforms and institution building are ongoing. After significant improvements to achieve peace and security, the country’s development program is shifting gradually towards modernizing public finance. However, the government has limited “fiscal space” because tax collection is very hard to carry out and tax receipts are low.

- With its limited resources, the government is attempting to strengthen basic social services and upgrade infrastructure and institutions, particularly in the energy, mining, and agricultural sectors. This has been accompanied by increasing participation of the private sector. The goal now is to grow a more stable, competitive and diversified economy with enhanced opportunities for employment and improved standards of living.

- Over the last decade, annual economic growth in Burundi has been between 4 % and 5 %. Inflation continues to decline reaching 3.9 % in July 2016, down from 24 % in March 2012, reflecting a careful monetary policy helped by a recent decrease in the prices of imports, especially oil, which is an essential commodity.

- Burundi’s main exports are agricultural; coffee and tea account for 90 % of foreign exchange earnings, and exports are a relatively small share of Gross Domestic Product (GDP).

Question

Using an AD/AS diagram, explain why the “decrease in the prices of imports, especially oil” might reduce inflationary pressure (paragraph [5]).

▶️Answer/Explanation

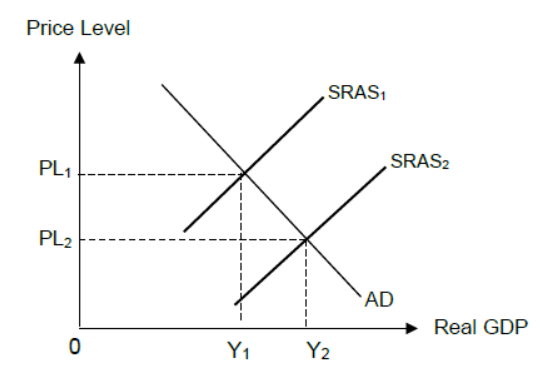

An AD/AS diagram showing a shift of the SRAS curve to the right and a fall in the average price level and an explanation that a fall in the price of imported factors of production will reduce costs for firms, reducing inflationary pressure in the economy.

OR

An AD/AS diagram showing a shift of the AD curve to the left and a fall in the average price level and an explanation that a fall in the price of imports would increase spending on imports, a component of AD and hence reduce inflationary pressure in the economy

Japan–European Union Economic Partnership Agreement (JEEPA)

- In July 2017, the Japan–European Union Economic Partnership Agreement (JEEPA) was announced and it may come into force in 2019. Jointly, Japan and the European Union (EU) currently account for 28 % of global gross domestic product (GDP). The trade agreement could raise the EU’s exports to Japan by 34 % and Japan’s exports to the EU by 29 %. Economists say that this trade agreement marks a determined effort to combat rising protectionism and sends a powerful signal that cooperation, not trade protection, is the way to tackle global challenges.

- The largest benefit to Japan will be for Japanese car manufacturers, as Europe will gradually lower tariffs from 10 % on Japanese cars. Car tariffs are a big concern for Japanese car manufacturers, who struggle to compete with South Korean car manufacturers. South Korean cars are sold to the EU tariff-free thanks to a free trade agreement signed in 2011. Within Europe, car manufacturers are one of the largest sources of jobs. Car manufacturers in the EU are concerned that cutting tariffs on car imports from Japan may lead to a large increase of Japanese cars into the European market.

- The trade agreement will also resolve non-tariff barriers, such as technical requirements and regulations. More importantly, however, the EU and Japan will make their environmental and safety standards on cars the same, which will make trade easier.

- Japanese politicians have been defending their relatively inefficient farmers for a long time. Now, Japan will lower tariffs on European meat, dairy products and wine, cutting 85 % of the tariffs on food products coming into Japan. This includes removing the current 30 % tariff on some European cheeses, such as cheddar and gouda cheese. However, imported camembert cheese will face a quota. This may be because Japan produces some camembert cheese.

- JEEPA is particularly alarming for United States (US) beef and pork farmers because Japan has been the biggest export market for US beef and the second biggest export market for US pork. Any preferential tariff that EU farmers receive will make it much tougher for American farmers to sell meat in Japan.

- With this trade agreement, the EU and Japan are trying to promote the values of economic cooperation and environmental conservation, which are both important for long-term economic growth and sustainability. However, JEEPA faces significant challenges because it will have to be passed by the Japanese Parliament, the European Parliament and European national governments. There is no guarantee that all governments will agree to the economic partnership.

Question

Using an AD/AS diagram, explain the impact of the trade agreement between Japan and the EU (JEEPA) on Japan’s economic growth (paragraph [1]).

▶️Answer/Explanation

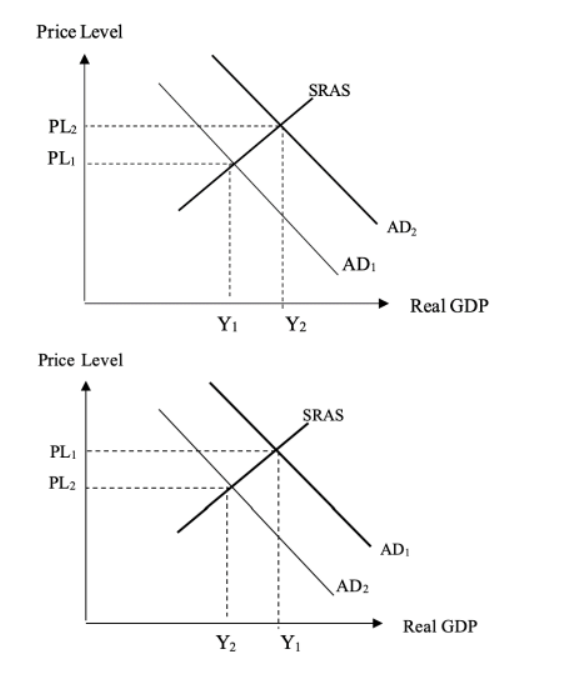

For drawing an accurate, labelled AD/AS diagram showing a shift of the AD curve to the right and an increase in the price level and real GDP AND for an explanation that the trade deal could raise Japan’s exports by 29%, increasing Japan’s export revenue, a component of AD. This may increase Japan’s real GDP, thus leading to economic growth.

OR

For drawing an accurate, labelled AD/AS diagram showing a shift of the AD curve to the left and a decrease in the price level and real GDP AND for an explanation that the trade deal could raise Japan’s exports by 29% but also increase EU imports by 34%, decreasing Japan’s net exports, a component of AD. This may decrease Japan’s real GDP, thus negatively affecting economic growth.

China’s trade reforms

- The Chinese government has announced a set of free trade measures, including lower import tariffs on cars, soybeans and pharmaceuticals, in an attempt to end a trade war with the United States (US).

- The US government has long accused China of engaging in unfair trade practices to maintain their current account surplus. The trade dispute between the two largest economies intensified when the US said it would impose anti-dumping tariffs on Chinese steel and aluminium.

- The trade war with the US comes at a bad time given the slowdown in China’s domestic demand. In recent years, China’s economic growth has relied less on investment and exports and more on consumption expenditure.

- Producers of many Chinese manufactured goods currently benefit from protectionist measures. In particular, imports of industrial equipment, medical devices, tractors and vehicles are subject to high tariffs.

- Automobile production capacity in China is growing. However, the domestic market is becoming oversupplied, with more cars being offered for sale than Chinese consumers want to buy. For this reason, Chinese car manufacturers are seeking to export their cars to other markets. They are therefore eager to see reduced trade tensions as increased US tariffs would make it harder to export Chinese cars to the US.

- Some Chinese car manufacturers are already focusing on adding advanced capabilities to their cars in order to be more competitive in global markets. China is increasing its efforts to become a world leader in self-driving cars. These will be intelligent cars that will improve transport efficiency and meet energy-saving and emission-reduction targets. Many believe that Chinese companies are so innovative that they no longer require protection from international enterprises.

- However, many Chinese firms remain dependent on imported factors of production. Approximately 30 % of Chinese exports are manufactured using imported equipment and components. The reduction of tariffs would therefore lower prices not only for producers but also for consumers of Chinese goods.

Question

Define the term consumption indicated in bold in the text (paragraph [3]).

▶️Answer/Explanation

An explanation that is spending by the households/ peoples on goods (and services)

The fall of the Indian rupee

- Over the past year, India’s current account deficit widened as the 14 % increase in export revenue could not offset the rise in import expenditure. Over the same period, the value of the rupee (India’s currency) has fallen by 13 %.

- The rise in import expenditure was in part caused by higher oil prices following production cuts by the Organization of the Petroleum Exporting Countries (OPEC). Another reason for the increase in import expenditure was the higher spending on machinery and capital goods needed to achieve economic growth.

- Exports of services, especially software services, have helped to boost export revenue. However, one critical weakness in India’s exports of services is the lack of diversification. Exports of software services account for more than 41 % of India’s total service exports and more than 90 % of its software service exports are restricted to the United States and the European Union.

- The depreciation of the rupee, one of the steepest seen in recent years, has resulted in fears of high inflation. An economist at the Reserve Bank of India (India’s central bank) has warned that the increase in oil prices and consumers’ expectations of rising inflation could worsen inflationary pressures.

- Despite calls for an increase in interest rates in order to protect the rupee from further depreciation, the Reserve Bank of India has chosen to keep interest rates unchanged. The combined effect of a fall in confidence and higher interest rates would dampen economic growth.

Question

Using an AD/AS diagram, explain how an increase in oil prices “could worsen inflationary pressures” (paragraph [4]).

▶️Answer/Explanation

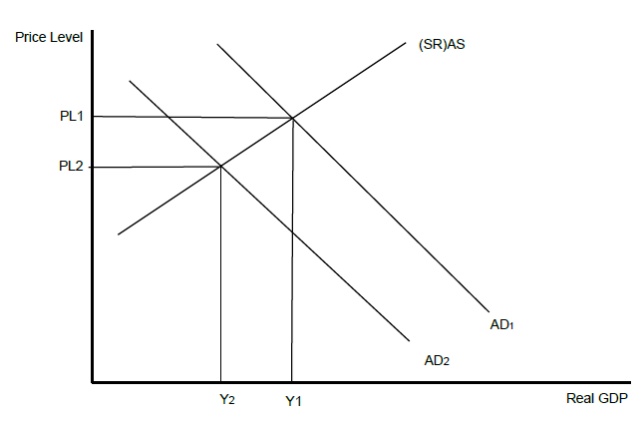

An AD/AS diagram showing a shift of SRAS/AS to the left and an increase in the price level AND an explanation that the higher price of oil would increase the cost of production and hence lead to (cost-push) inflation.

Angola’s economic reforms

- Following an oil price crash in 2014, Angola has endured a recession, a dramatic rise in inflation and empty supermarket shelves caused by severe shortages of foreign currency. Angola is highly dependent on export revenues from oil production, a major source of United States dollars. The foreign currency is needed to import manufactured goods because the country’s manufacturing sector is small.

- To respond to these challenges, the president of Angola has presented a plan with desperately needed reforms to promote economic development. The plan proposes tax incentives to attract foreign investment and privatization of the telecommunication and railway sectors. It also aims to expand infrastructure projects with private sector involvement. In addition, reforms are recommended to make the banking sector stronger. This is important if the government wants to reduce the borrowing costs experienced by Angolan businesses.

- The recent 20 % devaluation of the kwanza (Angola’s currency) is another sign that the government is serious about making Angola attractive to foreign direct investment (FDI). Angola has a fixed exchange rate. As the kwanza has been overvalued, this has caused a reduction in foreign currency reserves.

- Angola’s future economic growth is likely to be low. The business environment for firms remains difficult. High borrowing costs, corruption and poor infrastructure remain challenges. The government has failed to exploit Angola’s vast agricultural potential. The country depends heavily on oil revenues, which are falling.

- Living conditions for households are also poor as inflation is expected to remain above 25 %. Approximately 40 % of Angolans live in absolute poverty and unemployment is high, especially in rural areas. Aware of the urgent need to reduce regional inequality, the government has announced plans to encourage investment in rural areas. However, there are also proposals to reduce public debt by removing some subsidies on food and by introducing ad valorem taxes.

- Although Angola’s economic growth has been slow, it remains the third-largest economy in sub-Saharan Africa and the government is the second-largest public spender in the region.

Question

Define the term recession indicated in bold in the text (paragraph [1]).

▶️Answer/Explanation

An explanation that there are atleast two consecutive quarters of negative economic growth/falling real GDP or a sustained decline in economic activity

Economic growth in Laos

- The construction of the China–Laos railway is a major contributor to Laos’ economic growth. This landlocked country is projected to grow by 7 % this year, which is a good achievement for a country still experiencing low incomes and over-reliance on the agricultural sector.

- The 420 kilometre railway line will connect China to Laos and link Southeast Asian countries all the way to Singapore. The railway will improve the communication between resource-rich Laos and its neighbours, all of which have larger markets. This will increase both trade and tourism in the region. With the help of Chinese investment, the Lao government also plans to increase its hydroelectric power generation capacity in the next 12 years. This could mean a total of 429 dams on the Mekong River by 2030. However, environmentalists say that the excessive construction of dams could destroy the ecosystem.

- Five years ago, the Lao government introduced a policy to privatize state-owned property, designed to attract foreign direct investment (FDI). The privatization policy was especially appealing to Chinese investors and has succeeded in increasing FDI in Laos. The Lao government sold a share in its telecommunication industry to a Chinese firm, which helped launch Laos’ first satellite. This not only improved internet connection quality for communication purposes but also made health services and education more accessible in rural areas, where 61 % of the labour force work as farmers.

- The Lao government hopes that Chinese investment will not only introduce technological innovations but will also bring jobs that would help many of the citizens of Laos to break out of the poverty trap. Six Chinese construction companies are now carrying out construction along the entire railway track and are employing a total of 50000 workers, although these are mostly Chinese.

- Many are concerned that Laos may be heading for a debt crisis with so much investment financed through borrowing. The construction of the railway will cost an estimated US$6 billion, which will be 60 % funded by foreign investors. The governments of China and Laos will finance the remaining 40 %. Laos’ total commitment to the building of this infrastructure is US$840 million. Around US$500 million of that amount will come from loans from China. The remaining amount will be drawn from the government budget.

Question

Using an externalities diagram, explain why the construction of dams on the Mekong River might lead to market failure (paragraph [2]).

▶️Answer/Explanation

For drawing an externalities diagram showing a negative externality with MSC above MPC and overproduction taking place (Qm > Qso) AND for explaining that hydroelectric power dam projects may be a market failure if they create external costs (or negative externalities) resulting in any one of the following:

- a misallocation of resources

- a situation where the market is operating at a level where MSC>MSB

- a situation where the market is operating at a level that is not socially efficient (MSB≠ MSC)

- a situation where there is a welfare loss to society.

South Korea’s exchange rate and central bank intervention

- From mid-2017 until mid-2019, there was a downward trend in the exchange rate of the South Korean won (South Korea’s currency), and some commentators suggested that it was being deliberately undervalued. Despite the lower exchange rate, however, the value of South Korean exports declined by 10.3 % during 2019.

- The main reason for the decline in the value of exports was the weak market for semiconductors. Lower global prices of semiconductors, the largest single export item for South Korea, led to a drop of 25.9 % in the value of exports, despite an increase in their volume. Evidently, price competitiveness of exports from South Korea is not as significant as before, because its exports are now mainly luxury or high-technology items.

- In November 2019, South Korea’s current account surplus reached US$5.97 billion, more than 4 % of gross domestic product (GDP). The financial account in the balance of payments had a net outflow of US$5.34 billion, which was mainly due to a net outflow of US$4.01 billion in foreign direct investment (FDI). There was also a net outflow of US$1.07 billion in portfolio investment, because domestic residents increased their financial assets overseas while inward flows declined.

- The Bank of Korea (South Korea’s central bank, BoK) had reduced interest rates to record lows in October 2019, which partly accounted for the large portfolio investment outflows. Monetary policy is likely to continue to be expansionary through 2020, with the possibility of another interest rate reduction, because economic growth is forecast to be low, at less than 2.5 %. The forecast for inflation is that it will be below 1.5 %, while the unemployment rate is expected to continue to rise to over 4 %.

- While the BoK is not targeting a specific level for the exchange rate, it seems determined to intervene when the market is unstable. Its actions, however, have contributed to South Korea being accused by the United States (US) of changing the value of its currency to gain an export advantage. If the US concludes that South Korea has been manipulating its exchange rate unfairly, it could impose trade barriers on imports from South Korea.

- However, through the last six months of 2019, the South Korean won started to rise against the US dollar (US$). The appreciation was partly due to speculation and expectations of a rise in demand for semiconductors. Moreover, in August 2019, the BoK sold US dollars in order to prevent the South Korean won from depreciating again. Overall, the central bank’s foreign exchange intervention has been aimed at restraining the South Korean won’s depreciation or stabilizing the market rather than at trying to promote exports.

Question

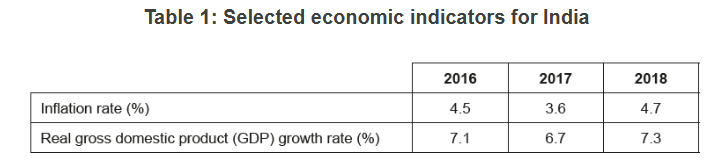

Using an AD/AS diagram, explain how the change in the balance of trade in goods and services from 2018 to 2019 could have affected South Korea’s economy (Table 1 and paragraph [1]).

▶️Answer/Explanation

For drawing a correctly labelled AD/AS diagram, with the AD curve shifting left (downwards) and the equilibrium output and price level falling

AND for an explanation that the lowering of the surplus on the trade balance (X-M) will lower AD, leading to a fall in real GDP/growth and/or a lower price level/rate of inflation.

Bank of Canada raises interest rates for the first time in seven years

- For seven years Canada’s central bank, the Bank of Canada, kept its official interest rate at 0.5 %. This period of easy monetary policy may be coming to an end. The Bank of Canada has just raised its official interest rate from 0.5 % to 0.75 %, claiming that there is new confidence in the Canadian economy. Figures show that the 3.5 % growth in gross domestic product (GDP) in the first quarter of 2017 is above its potential. In addition, the Bank of Canada expects growth in consumer spending, exports and business investment to stimulate economic growth in the months ahead. Such factors might contribute to inflationary pressure in the future.

- One of the issues that might have delayed the interest rate increase in Canada is that the inflation rate is still low and falling. Central banks typically raise interest rates when inflation is rising. That is not the problem in Canada, where the consumer price index (CPI) has been rising at well below the Bank of Canada’s 2 % inflation target. However, the governor of the Bank of Canada says that he is looking at forecasts of future inflation rates, noting that the data suggest the interest rate increase is necessary. An official statement from the Bank of Canada notes that growth is increasing across all industries and regions and that the economy has started to improve. There is no longer a need for the low interest rate.

- Positive economic growth figures, the optimism shown by the Bank of Canada, and the recent interest rate increase have caused a rapid appreciation of the Canadian dollar against the United States (US) dollar over recent months. There are now expectations that the Bank of Canada will raise the interest rate once or possibly twice more before the end of the year, as signs continue to point to a healthy economy. This would likely cause further strengthening of the Canadian dollar against the US dollar.

- An economist has said that the gain in the Canadian dollar against the US dollar may have a large effect on importers and exporters, although it will likely be months before consumers see the effects. She further noted that the effects would vary across different industries. There is some concern about the consequences for the Canadian current account. Currently the current account deficit is at 3.6 % of GDP.

- A stronger currency is also likely to encourage more Canadians to travel south to the US.

Question

Using an AD/AS diagram, explain the likely impact on the Canadian economy of the increase in the official interest rate (paragraph [1]).