IBDP Economics SL – The global economy – Types of trade protection -Paper 2 Exam Style Practice Questions

Types of trade protection Paper 2?

Exam Style Questions..

Subject Guide IBDP Economic IBO

IBDP Economic SL- All Topics

Exam Style Question for Types of trade protection -Paper 2

United States (US) tin can manufacturers seek tariff exemption on tinplate steel

- The Can Manufacturers Institute (CMI) has asked the US Department of Commerce to take away tariffs and other trade protection measures that are currently applied to imports of tinplate steel. Tinplate steel is used to make tin cans as packaging for food. The CMI represents the tin can manufacturing industry and its suppliers in the US.

- The tin can manufacturing industry accounts for the annual domestic production of approximately 124 billion tin cans. The industry employs more than 28 000 people, with factories in 33 US states, Puerto Rico and American Samoa. It generates revenue of around US$17.8 billion. The CMI claims that the tariff on imports of tinplate steel has a severe economic impact on the tin can manufacturing industry.

- Approximately 2 % of all US steel is tinplate. Currently, there is excess demand that is causing a disequilibrium in the domestic US tinplate steel market. In 2016, US demand for tinplate steel was 2.1 million tons, while domestic supply was 1.2 million tons, meaning that only 57 % of domestic demand was met by US tinplate steel producers. Not only is there a domestic shortage of tinplate steel, but also the CMI claims that there has been a noticeable decline in the quality of domestically-produced tinplate steel.

- The CMI claims that even a small increase in the price of raw materials could create a competitive disadvantage, forcing some tin can manufacturing plants to shut down. This would create structural unemployment for 10 000 workers in regionally-based factories. The CMI also claims that the tariff puts food can producers at a competitive disadvantage with other food packaging substitutes, such as plastic and glass. These substitutes are not subject to tariffs.

- According to the CMI, canned fruits and vegetables cost 20 % less than fresh food. Because of this, people on low incomes consume canned foods at a higher rate than the average American. Canned food offers a low-cost solution to feeding the nation; especially the 42 million Americans who live in low-income households. The figure includes 13 million children. The CMI further claims that tariffs, or any trade barriers, have harsh consequences for those living in relative poverty.

Question

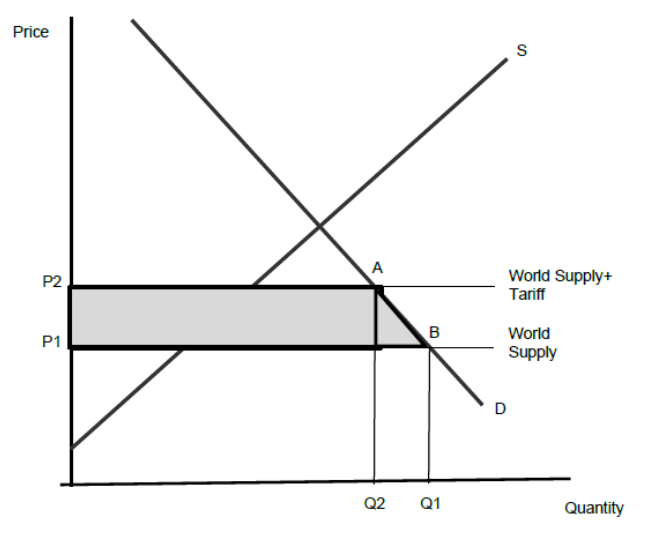

Using an international trade diagram, explain the effect of a tariff on the imports of tinplate steel (paragraph [1]).

▶️Answer/Explanation

For drawing a correctly labelled trade diagram, with an upward shift of the world supply curve, an increase in price, and a fall in the level of imports AND for an explanation that a tariff will result in an increase in the price of tinplate steel and hence a fall in the quantity of imports due to an increase in the domestic quantity supplied (and/or decrease in quantity demanded).

Japan–European Union Economic Partnership Agreement (JEEPA)

- In July 2017, the Japan–European Union Economic Partnership Agreement (JEEPA) was announced and it may come into force in 2019. Jointly, Japan and the European Union (EU) currently account for 28 % of global gross domestic product (GDP). The trade agreement could raise the EU’s exports to Japan by 34 % and Japan’s exports to the EU by 29 %. Economists say that this trade agreement marks a determined effort to combat rising protectionism and sends a powerful signal that cooperation, not trade protection, is the way to tackle global challenges.

- The largest benefit to Japan will be for Japanese car manufacturers, as Europe will gradually lower tariffs from 10 % on Japanese cars. Car tariffs are a big concern for Japanese car manufacturers, who struggle to compete with South Korean car manufacturers. South Korean cars are sold to the EU tariff-free thanks to a free trade agreement signed in 2011. Within Europe, car manufacturers are one of the largest sources of jobs. Car manufacturers in the EU are concerned that cutting tariffs on car imports from Japan may lead to a large increase of Japanese cars into the European market.

- The trade agreement will also resolve non-tariff barriers, such as technical requirements and regulations. More importantly, however, the EU and Japan will make their environmental and safety standards on cars the same, which will make trade easier.

- Japanese politicians have been defending their relatively inefficient farmers for a long time. Now, Japan will lower tariffs on European meat, dairy products and wine, cutting 85 % of the tariffs on food products coming into Japan. This includes removing the current 30 % tariff on some European cheeses, such as cheddar and gouda cheese. However, imported camembert cheese will face a quota. This may be because Japan produces some camembert cheese.

- JEEPA is particularly alarming for United States (US) beef and pork farmers because Japan has been the biggest export market for US beef and the second biggest export market for US pork. Any preferential tariff that EU farmers receive will make it much tougher for American farmers to sell meat in Japan.

- With this trade agreement, the EU and Japan are trying to promote the values of economic cooperation and environmental conservation, which are both important for long-term economic growth and sustainability. However, JEEPA faces significant challenges because it will have to be passed by the Japanese Parliament, the European Parliament and European national governments. There is no guarantee that all governments will agree to the economic partnership.

Question

Define the term quota indicated in bold in the text (paragraph [4]).

▶️Answer/Explanation

An understanding that it is a physical limit on the quantity or value of a good that can be imported into a country

Japan–European Union Economic Partnership Agreement (JEEPA)

- In July 2017, the Japan–European Union Economic Partnership Agreement (JEEPA) was announced and it may come into force in 2019. Jointly, Japan and the European Union (EU) currently account for 28 % of global gross domestic product (GDP). The trade agreement could raise the EU’s exports to Japan by 34 % and Japan’s exports to the EU by 29 %. Economists say that this trade agreement marks a determined effort to combat rising protectionism and sends a powerful signal that cooperation, not trade protection, is the way to tackle global challenges.

- The largest benefit to Japan will be for Japanese car manufacturers, as Europe will gradually lower tariffs from 10 % on Japanese cars. Car tariffs are a big concern for Japanese car manufacturers, who struggle to compete with South Korean car manufacturers. South Korean cars are sold to the EU tariff-free thanks to a free trade agreement signed in 2011. Within Europe, car manufacturers are one of the largest sources of jobs. Car manufacturers in the EU are concerned that cutting tariffs on car imports from Japan may lead to a large increase of Japanese cars into the European market.

- The trade agreement will also resolve non-tariff barriers, such as technical requirements and regulations. More importantly, however, the EU and Japan will make their environmental and safety standards on cars the same, which will make trade easier.

- Japanese politicians have been defending their relatively inefficient farmers for a long time. Now, Japan will lower tariffs on European meat, dairy products and wine, cutting 85 % of the tariffs on food products coming into Japan. This includes removing the current 30 % tariff on some European cheeses, such as cheddar and gouda cheese. However, imported camembert cheese will face a quota. This may be because Japan produces some camembert cheese.

- JEEPA is particularly alarming for United States (US) beef and pork farmers because Japan has been the biggest export market for US beef and the second biggest export market for US pork. Any preferential tariff that EU farmers receive will make it much tougher for American farmers to sell meat in Japan.

- With this trade agreement, the EU and Japan are trying to promote the values of economic cooperation and environmental conservation, which are both important for long-term economic growth and sustainability. However, JEEPA faces significant challenges because it will have to be passed by the Japanese Parliament, the European Parliament and European national governments. There is no guarantee that all governments will agree to the economic partnership.

Question

Using an international trade diagram, explain the likely impact of Japan “removing the current 30 % tariff” on the level of cheddar cheese imports. (paragraph [4]).

▶️Answer/Explanation

For drawing an accurate, labelled international trade diagram showing a tariff being removed on European Cheddar cheese in the Japanese Cheddar market indicating an increase in the level of imports AND for explaining that a removal of the tariff on Cheddar cheese will cause a decrease in the price of cheddar cheese and hence an increase in the amount of imports that Japan will buy from Europe due to a decrease in the quantity supplied by Japanese producers (and/or increase in quantity demanded by Japanese consumers).

Unwanted consequences of United States–China trade war

- In order to reduce its trade deficit, the United States (US) announced tariffs of 25 % on imports of steel and 10 % on imports of aluminium from various countries in March 2018. The US government also accused China of unfair trade practices and wants China to import more American-made products.

- In July 2018, the first tariff on Chinese imports took effect and the Chinese government retaliated with a ban on US soybeans. In response, the US threatened to impose additional tariffs on imports worth almost US$300 billion, including a 25 % tariff on cars and car parts. This would be very damaging to the Chinese economy, which is slowing down, and workers in some provinces have become unemployed.

- The trade war has also caused anxiety in the European Union and Australia, which are likely to see their trade with China affected. Global trade in goods has been slowing, with exports from trade-dependent nations (such as Japan and South Korea) to China declining. Economists have estimated that other countries could see exports to China drop by as much as 20 %. As of early 2019, Germany’s economy is almost in recession, partly because of the slowing Chinese economy. If the US imposes its threatened car tariffs, a recession in Germany is inevitable.

- In the US, concerns were raised that the trade war has reduced business confidence. The decrease in demand from China, which results partly from trade tensions, has hurt the profits of US companies such as Apple Inc. and Caterpillar Inc. On the other hand, consumers and producers in the US are switching to domestically-produced goods due to the higher prices of some imported products from China.

- In an attempt to reduce the risk of a sharp economic slowdown, China’s central bank eased monetary policy. Economic data showed that small- and medium-sized manufacturing companies saw the largest negative impact from the slowdown of its economy. Therefore, the government changed the definition of a “small business”, allowing more firms to have access to subsidized lending by state-owned commercial banks.

- As the impacts of tax cuts enacted in the US in 2017 are disappearing, the US government is becoming more aware that the US economy is hurt by the trade war and is heading towards slower growth.

Question

Using an international trade diagram, explain the outcome on US producers of the introduction of a tariff on imports from China (paragraph [2]).

▶️Answer/Explanation

A tariff diagram showing a shift upwards of the world supply curve AND for providing an explanation that the tariff causes the price to rise (world supply curve shifts upwards), and therefore the US producers will produce more (receive a higher revenue).

China’s trade reforms

- The Chinese government has announced a set of free trade measures, including lower import tariffs on cars, soybeans and pharmaceuticals, in an attempt to end a trade war with the United States (US).

- The US government has long accused China of engaging in unfair trade practices to maintain their current account surplus. The trade dispute between the two largest economies intensified when the US said it would impose anti-dumping tariffs on Chinese steel and aluminium.

- The trade war with the US comes at a bad time given the slowdown in China’s domestic demand. In recent years, China’s economic growth has relied less on investment and exports and more on consumption expenditure.

- Producers of many Chinese manufactured goods currently benefit from protectionist measures. In particular, imports of industrial equipment, medical devices, tractors and vehicles are subject to high tariffs.

- Automobile production capacity in China is growing. However, the domestic market is becoming oversupplied, with more cars being offered for sale than Chinese consumers want to buy. For this reason, Chinese car manufacturers are seeking to export their cars to other markets. They are therefore eager to see reduced trade tensions as increased US tariffs would make it harder to export Chinese cars to the US.

- Some Chinese car manufacturers are already focusing on adding advanced capabilities to their cars in order to be more competitive in global markets. China is increasing its efforts to become a world leader in self-driving cars. These will be intelligent cars that will improve transport efficiency and meet energy-saving and emission-reduction targets. Many believe that Chinese companies are so innovative that they no longer require protection from international enterprises.

- However, many Chinese firms remain dependent on imported factors of production. Approximately 30 % of Chinese exports are manufactured using imported equipment and components. The reduction of tariffs would therefore lower prices not only for producers but also for consumers of Chinese goods.

Question

Define the term trade war indicated in bold in the text (paragraph [1])

▶️Answer/Explanation

An explanation that the imposition of a trade barrier by one country can trigger a series of retaliations by (a) trade partners

China’s trade reforms

- The Chinese government has announced a set of free trade measures, including lower import tariffs on cars, soybeans and pharmaceuticals, in an attempt to end a trade war with the United States (US).

- The US government has long accused China of engaging in unfair trade practices to maintain their current account surplus. The trade dispute between the two largest economies intensified when the US said it would impose anti-dumping tariffs on Chinese steel and aluminium.

- The trade war with the US comes at a bad time given the slowdown in China’s domestic demand. In recent years, China’s economic growth has relied less on investment and exports and more on consumption expenditure.

- Producers of many Chinese manufactured goods currently benefit from protectionist measures. In particular, imports of industrial equipment, medical devices, tractors and vehicles are subject to high tariffs.

- Automobile production capacity in China is growing. However, the domestic market is becoming oversupplied, with more cars being offered for sale than Chinese consumers want to buy. For this reason, Chinese car manufacturers are seeking to export their cars to other markets. They are therefore eager to see reduced trade tensions as increased US tariffs would make it harder to export Chinese cars to the US.

- Some Chinese car manufacturers are already focusing on adding advanced capabilities to their cars in order to be more competitive in global markets. China is increasing its efforts to become a world leader in self-driving cars. These will be intelligent cars that will improve transport efficiency and meet energy-saving and emission-reduction targets. Many believe that Chinese companies are so innovative that they no longer require protection from international enterprises.

- However, many Chinese firms remain dependent on imported factors of production. Approximately 30 % of Chinese exports are manufactured using imported equipment and components. The reduction of tariffs would therefore lower prices not only for producers but also for consumers of Chinese goods.

Question

Using an international trade diagram, explain how US tariffs could affect the export of Chinese steel and aluminium to the US (paragraph [2]).

▶️Answer/Explanation

For an international trade diagram showing the imposition of a (or an increase in a) tariff in the US market and the world (China’s) supply (Sworld/Schina) shifting up AND for an explanation that a tariff would increase the price of steel and aluminium and thus reduce the amount of steel and aluminium imported from China (exported to the US) from Q1Q4 to Q2Q3.

China’s trade reforms

- The Chinese government has announced a set of free trade measures, including lower import tariffs on cars, soybeans and pharmaceuticals, in an attempt to end a trade war with the United States (US).

- The US government has long accused China of engaging in unfair trade practices to maintain their current account surplus. The trade dispute between the two largest economies intensified when the US said it would impose anti-dumping tariffs on Chinese steel and aluminium.

- The trade war with the US comes at a bad time given the slowdown in China’s domestic demand. In recent years, China’s economic growth has relied less on investment and exports and more on consumption expenditure.

- Producers of many Chinese manufactured goods currently benefit from protectionist measures. In particular, imports of industrial equipment, medical devices, tractors and vehicles are subject to high tariffs.

- Automobile production capacity in China is growing. However, the domestic market is becoming oversupplied, with more cars being offered for sale than Chinese consumers want to buy. For this reason, Chinese car manufacturers are seeking to export their cars to other markets. They are therefore eager to see reduced trade tensions as increased US tariffs would make it harder to export Chinese cars to the US.

- Some Chinese car manufacturers are already focusing on adding advanced capabilities to their cars in order to be more competitive in global markets. China is increasing its efforts to become a world leader in self-driving cars. These will be intelligent cars that will improve transport efficiency and meet energy-saving and emission-reduction targets. Many believe that Chinese companies are so innovative that they no longer require protection from international enterprises.

- However, many Chinese firms remain dependent on imported factors of production. Approximately 30 % of Chinese exports are manufactured using imported equipment and components. The reduction of tariffs would therefore lower prices not only for producers but also for consumers of Chinese goods.

Question

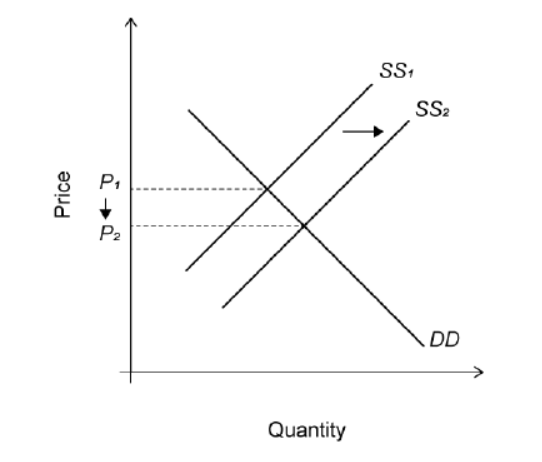

Using a demand and supply diagram, explain how reduced tariffs on “imported factors of production” would affect the price of Chinese goods (paragraph [7]).

▶️Answer/Explanation

For a demand and supply diagram showing a shift of the supply curve to the right and a decrease in price AND for an explanation that a lower tariff on imported factors of production would reduce the costs of factors of production for firms, leading to lower prices.

China and global trade

- On 15 January 2020, the United States (US) and China signed a deal that reduced some tariffs and required China to buy more from US producers. This was a first step towards resolving a trade war, which had reduced bilateral trade flows by 9 % and investment flows by 60 %. However, critics argued that the deal left most tariffs unchanged and did not deal with deeper disagreements.

- The US, the European Union (EU) and Japan are calling for tougher World Trade Organization (WTO) rules on government support for firms that manufacture items such as steel or solar panels. The support, which is often in the form of subsidies, has allegedly undermined competing firms overseas, either by promoting exports or by decreasing imports, and therefore distorted global trade. Other governments also give subsidies, but there are claims that China uses them more extensively.

- The proposed WTO rule change would require governments to prove that subsidies do not give domestic firms an unfair advantage over foreign firms and that they do not lead to excess supply in the global market. If the rules are implemented, the WTO may regain some of the authority that it has lost in recent years.

- One of the US government’s goals when imposing huge tariffs on Chinese-made goods was to bring back manufacturing jobs to the US. Therefore, despite the new deal, the 25 % tariff on Chinese-made furniture will stay. As a result, many US furniture firms that had used overseas factories to make their US company-branded products have reduced their imports of Chinese-made furniture.

- Meanwhile, Vietnam, Cambodia and Bangladesh are benefitting because US manufacturers of wood furniture are setting up factories there. Therefore, some other US producers are asking for the tariff on Chinese-made wooden furniture to apply to all wooden furniture imported into the US, regardless of where it is manufactured.

- China is becoming less dominant as an exporter and more integrated into the global trading system. Its current account surplus was over 10 % of gross domestic product (GDP) in 2007, but it declined to just 0.4 % in 2018. Chinese producers are increasingly buying raw materials and other inputs from overseas producers. Although most electronic devices sold in the US are assembled in China, Chinese firms are often dependent on foreign suppliers. If the US and China tried to be less interdependent, it would take more than 10 years for China to become self-sufficient in the production of computer semiconductors and for the US to shift to other suppliers of electronic devices.

Question

Using a tariff diagram, explain the likely effect on consumer surplus of a 25 % tariff on all wooden furniture imported into the US (paragraph [5]).

▶️Answer/Explanation

For drawing a correctly labelled tariff diagram, with a horizontal world supply line and another higher horizontal line to show the effect of the tariff with the reduction in consumer surplus shaded or otherwise indicated AND for an explanation that because of the tariff, consumers pay a higher price and buy a smaller quantity leading to a reduction in consumer surplus.

China and global trade

- On 15 January 2020, the United States (US) and China signed a deal that reduced some tariffs and required China to buy more from US producers. This was a first step towards resolving a trade war, which had reduced bilateral trade flows by 9 % and investment flows by 60 %. However, critics argued that the deal left most tariffs unchanged and did not deal with deeper disagreements.

- The US, the European Union (EU) and Japan are calling for tougher World Trade Organization (WTO) rules on government support for firms that manufacture items such as steel or solar panels. The support, which is often in the form of subsidies, has allegedly undermined competing firms overseas, either by promoting exports or by decreasing imports, and therefore distorted global trade. Other governments also give subsidies, but there are claims that China uses them more extensively.

- The proposed WTO rule change would require governments to prove that subsidies do not give domestic firms an unfair advantage over foreign firms and that they do not lead to excess supply in the global market. If the rules are implemented, the WTO may regain some of the authority that it has lost in recent years.

- One of the US government’s goals when imposing huge tariffs on Chinese-made goods was to bring back manufacturing jobs to the US. Therefore, despite the new deal, the 25 % tariff on Chinese-made furniture will stay. As a result, many US furniture firms that had used overseas factories to make their US company-branded products have reduced their imports of Chinese-made furniture.

- Meanwhile, Vietnam, Cambodia and Bangladesh are benefitting because US manufacturers of wood furniture are setting up factories there. Therefore, some other US producers are asking for the tariff on Chinese-made wooden furniture to apply to all wooden furniture imported into the US, regardless of where it is manufactured.

- China is becoming less dominant as an exporter and more integrated into the global trading system. Its current account surplus was over 10 % of gross domestic product (GDP) in 2007, but it declined to just 0.4 % in 2018. Chinese producers are increasingly buying raw materials and other inputs from overseas producers. Although most electronic devices sold in the US are assembled in China, Chinese firms are often dependent on foreign suppliers. If the US and China tried to be less interdependent, it would take more than 10 years for China to become self-sufficient in the production of computer semiconductors and for the US to shift to other suppliers of electronic devices.

Question

Using information from the text/data and your knowledge of economics, evaluate China’s use of subsidies as a form of trade protection.

▶️Answer/Explanation

Answers may include:

- definitions of trade protection, subsidy

- an international trade diagram showing the effect of a subsidy on imports and/or on exports.

Advantages of subsidies may include:

- goods with external benefits such as solar panels may need to be subsidised to ensure the optimum quantity is produced (paragraph [2])

- many other countries use subsidies and therefore China needs to use them to compete (paragraph [2])

- China’s trade surplus has already been reduced and might become a deficit if subsidies for key export industries are not provided (paragraph [6])

- prices of subsidised products will be lower for consumers

- reduces inflationary pressures in the economy.

Disadvantages of subsidies may include:

- they increase the misallocation of resources in world trade (paragraph [2])

- the complexity of supply chains makes it difficult to determine which firms are getting an unfair advantage (paragraph [6])

- they give a disadvantage to firms in competition with Chinese firms (paragraphs [2] and [3])

- they may lead to excess supply and dumping (paragraph [3])

- they make the WTO less effective, because its rules with regards to subsidies at present are too limited (paragraph [3])

- subsidies are a key component of the trade war, which contributes to reduced global trade and investment flows (paragraph [1])

- China’s use of subsidies limits production in other South East Asian economies, negatively impacting their growth and development (paragraph [5])

- the cost to governments of providing subsidies is high

- the welfare loss due to subsidies

- subsidies will reduce incentives for innovation/efficiency in domestic industry and long run competitiveness may deteriorate.

Text A — Overview of North Macedonia

- North Macedonia is a small, landlocked nation that shares borders with five countries, including Bulgaria and Greece. Bulgaria and Greece are members of the European Union (EU) common market, which North Macedonia hopes to join soon. Since the country began negotiating for EU membership, trade with the EU has increased rapidly and now accounts for 75 % of North Macedonia’s exports and 62 % of its imports.

- Despite its small market, with a population of approximately 2 million, North Macedonia’s proximity to the EU, low wages and expected entry into the common market have attracted foreign investors. Greece, its richest neighbour, was its third highest source of foreign investment in 2019. The lower cost of living also appeals to Greek tourists.

- EU companies have invested in the financial, telecommunication, energy and food processing industries in North Macedonia. Many of the most profitable companies are from the EU. If EU membership is granted, foreign direct investment (FDI) inflows may increase as firms located in North Macedonia will be allowed to bypass all custom checks and enjoy tariff-free trade within the common market. One particular challenge for North Macedonia, however, is that most of the profits of foreign companies are likely to be repatriated (sent back to the companies’ home countries).

- In 2018, North Macedonia’s export revenue was US\($\)7.57 billion and its import expenditure was US\($\)9.56 billion. The country’s main exports are iron and steel, clothing and accessories, and food products. Food, livestock and consumer goods account for 33 % of imports while the remainder are machinery, petroleum and other materials needed for the industrial production process.

- The manufacturing sector, which now employs 31 % of the labour force, has gained more importance. The agricultural sector remains strong, contributes over 10 % of North Macedonia’s gross domestic product (GDP) and employs about 16 % of the country’s workforce.

- The unemployment rate decreased from over 30 % in 2010 to 17.3 % in 2019. However, youth unemployment is almost 40 %. Over 20 % of the population lives below the poverty line. Unemployment and poverty contribute to high rates of emigration. More than 20 % of the North Macedonian population have emigrated since 1994, mostly to the EU. As a member of the EU, North Macedonia will enjoy free movement of labour which will make it easy for its citizens to live and work in other EU countries.

Text B — North Macedonia’s economic reforms

- To be considered for EU membership, North Macedonia implemented a series of supply-side policies to reform its economy. The EU imposes strict requirements for membership but provides financial assistance to countries preparing for membership. North Macedonia has received 633 million euros (the currency of the EU) to help with the reforms.

- Most of the supply-side policies seek to improve the international competitiveness of North Macedonia’s industries. The authorities are increasing access to education and training for workers. The expansion of the transport network and other infrastructure is also expected to increase efficiency.

- Protection of the environment is also on the list of requirements for EU membership. North Macedonia aims to reduce its dependence on coal and to instead promote the use of solar, wind and hydropower technologies. These low-carbon energy sources would help decrease its air pollution, which is among the worst in Europe.

- The reforms, which started in 2014, have shown progress. Exports and manufacturing output are more diversified and more concentrated on high-value products. To attract FDI, North Macedonia maintains one of the lowest tax rates on corporate income in the region. The central bank also prevents the denar (North Macedonia’s currency) from appreciating against the euro through managing foreign reserves. However, skill shortages and a mismatch of skills with those required by companies discourage foreign firms from investing. Important investment gaps in public infrastructure also remain.

Text C — North Macedonia’s trade agreements

North Macedonia participates in five free trade agreements (FTAs), that together cover 95 % of its exports and 78 % of its imports. Most of its trade with the EU is already free but imports of wine, beef and fish products are still subject to quotas. North Macedonia is currently a net importer of agricultural and food products. All protectionist measures on EU products would be removed upon entry into the common market.

Question

Using an international trade diagram, explain the likely impact of the removal of import quotas on North Macedonia’s production of wine (Text C).

▶️Answer/Explanation

For a correctly labelled trade diagram, showing a removal of the quota and a decrease in the quantity supplied by domestic producers AND for an explanation that a removal of the quota will result in a decrease in domestic production due to either in an increase in imports a decrease in the (domestic) price.

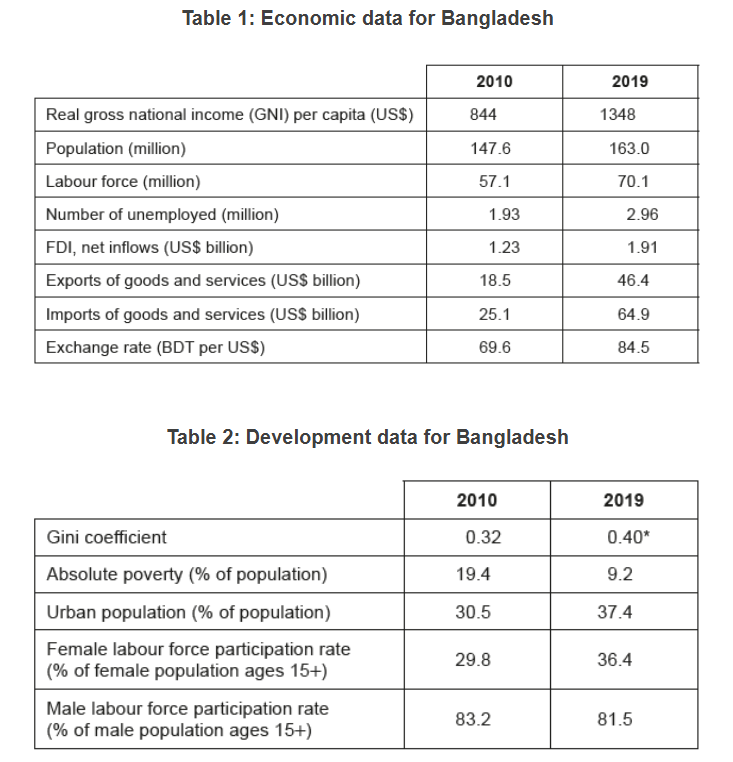

Text A — Bangladesh: the economic role of women

- Bangladesh is a densely populated country in Asia. Its currency is the Bangladeshi taka (BDT). The annual rate of growth of gross domestic product (GDP) has steadily increased from 5.6 in 2010 to 8.1 % in 2019.

- The structure of the economy is changing. The growth of cities is due to the expansion of the manufacturing sector, which now contributes a larger share to GDP than the agricultural sector. These changes have increased the number of women in the labour force. In particular, the growth of the ready-made garments (RMG) industry (mass-produced clothing) has given women the opportunity to move into formal employment. The RMG industry provides jobs for almost 4 million low-skilled and semi-skilled workers, accounting for over 40 % of total manufacturing employment. The majority of these jobs are being filled by women, with the result that the gap between the wages of men and women is gradually being reduced.

- There are concerns about working and safety conditions in the RMG factories. After an accident in a factory in 2013, reforms are being implemented, partly in response to criticisms from overseas retailers and consumers who purchase the garments. The minimum wage has been increased, inspections are carried out, and there are fewer small, unsafe factories.

- While working conditions are improving, such reforms raise the costs of manufacturing garments. Furthermore, the international garment market is becoming more competitive, putting pressure on Bangladeshi factories to reduce costs.

- The overseas demand for Bangladeshi garments had been rising strongly until 2019. However, demand has recently fallen, reducing firms’ revenue. The reduction in revenue and the need to lower costs have forced certain firms to reduce the size of their labour force by dismissing some of their female workers.

- The number of ethically and environmentally concerned consumers is increasing globally. Rather than trying to lower costs, firms can be more successful if they produce “green ready-made garments” by implementing sustainable practices. About 100 garment factories in Bangladesh have already been certified as producers that meet specified environmental standards. In addition, global retailers and fashion brands are supporting recycling initiatives through the Circular Fashion Partnership.

Text B — Trade prospects for exports of ready-made garments (RMG)

- Exports of RMG account for over 84 % of Bangladesh’s total exports. At present, Bangladesh is the world’s second largest garment exporter after China. Bangladeshi exports could further increase as Chinese garments become more expensive due to rising wages in China.

- Bangladesh is designated as an Economically Least Developed Country (ELDC) and is therefore able to sell goods in Europe and China without any quotas or tariffs being imposed. However, Bangladesh will graduate from ELDC status by 2026 and will then no longer be eligible for preferential trade agreements. Moreover, the USA, which is the largest export market for Bangladeshi garments, has applied a 15% tariff on imports from Bangladesh since 2013, citing concerns about working conditions in factories.

Text C — Role of foreign direct investment in the RMG sector

- Vietnam and Myanmar have significantly increased their garment exports to China due to foreign direct investment (FDI) from China. Chinese investors have set up factories that import raw materials from China and re-export the finished goods back to China.

- Consequently, to compete successfully in the huge Chinese market, Bangladesh needs to attract more FDI from China. Bangladesh is developing the required infrastructure, such as transport links. It is also necessary to diversify into expensive high-end fashion, market more aggressively, and use branding strategies.

- The funds from additional FDI would be helpful, because the relative contribution of Official Development Assistance (ODA) to Bangladesh’s budget is declining. Furthermore, the foreign exchange obtained from foreign investors assists in financing the current account deficit.

Question

Using an international trade diagram for the US market, explain how the imposition of a 15 % tariff on imported garments from Bangladesh would affect the revenue earned by Bangladeshi producers (Text B, paragraph [2]).

Absolute poverty

▶️Answer/Explanation

For a correct tariff diagram with appropriate labelling, showing a shift upwards of the world supply curve (world price line) and a fall in imports to the US, and showing a fall in revenue earned by Bangladeshi producers AND for providing an explanation that the tariff causes (higher prices for imports and therefore) imports to decrease, leading to lower revenue for the Bangladeshi producers.

Text D — Macroeconomic policies in Uruguay

- Compared to many other Latin American countries, Uruguay has a high Human Development Index (HDI). This is due to its higher gross national income (GNI) per capita and wider access to health care and education.

- One aim of Uruguay’s fiscal policy has been income redistribution. For example, in 2017 the tax rate applied to the highest income bracket was raised from 25

- Recently, concern about a growing budget deficit has led to new budget guidelines being implemented. These guidelines aim to reduce borrowing and the national debt by encouraging the government to increase tax revenue and/or reduce expenditures. The main policy goal of Uruguay’s central bank is to keep a low rate of inflation. It has announced that it will reduce the inflation target to below 6 % by September 2022.

- Several constraints to growth remain, which may limit progress towards sustainable development. Despite plans to upgrade road networks and construct a new central railway, investment in infrastructure needs to be increased further. Education and training could also be improved to meet the needs of new sectors, such as the information and communication technology (ICT) industry.

- State-owned enterprises, including railways and suppliers of fuel, water and electricity, are a significant part of the Uruguayan economy. The prices charged by these enterprises tend to be high relative to prices in other countries. As part of a strategy to eliminate excessive costs, the government has proposed measures to improve efficiency in state-owned enterprises and to gradually reduce prices.

- The International Monetary Fund (IMF) considers that more labour market flexibility is needed to make it easier for workers to change jobs and for firms in growing sectors such as ICT to hire workers. The government is, therefore, considering deregulation of the labour market.

- Overall, by boosting competitiveness and private investment through supply-side policies, the government aims to raise growth and employment.

Text E — Health care system in Uruguay

The public and private sectors that offer health care in Uruguay were combined into one system in 2007, with both overseen by the government and both eligible to receive subsidies. Most medical care is free for low-income patients. The first row of data in Table 3 shows that per capita demand for health care increased by 54.22 % from 2010 to 2018. The advantages are seen in longer life expectancy figures, which imply an increase in productivity, and other benefits.

Text F — Trade and exchange rates

- Over 50 % of Uruguayan exports are forestry and agricultural goods, including soybeans, rice, and cattle meat. Increasing global demand and a significant rise in commodity prices from 2000 to 2012 encouraged investment in the agricultural sector. However, the price of soybeans has been declining since 2013, partly due to rising productivity in agriculture. Climate-related shocks, such as droughts in 2017 and 2020, and economic crises in the major export markets of Brazil and Argentina have also caused difficulties for producers.

- Therefore, Uruguay aims to diversify its export markets. For example, with the growth of the ICT sector, Montevideo (the capital city of Uruguay) has become a leading software development centre. In addition, Uruguay is broadening its markets towards Europe and Asia. Under a proposed trade agreement between the European Union (EU) and the South American trade bloc, Mercosur (Argentina, Brazil, Paraguay, Venezuela, and Uruguay), 93 % of all tariffs will gradually be eliminated. However, a quota will be imposed on cheese imports from the EU.

- To help the economy adjust to external shocks and to avoid large fluctuations in the exchange rate of the peso (Uruguay’s currency), the central bank uses its plentiful reserve assets of foreign currencies. In 2019, the decline in agricultural export revenues put downward pressure on the peso exchange rate. However, the central bank was able to prevent a large depreciation by using its reserve assets in the foreign exchange market.

Question

Using an international trade diagram, explain the effect on consumers in Uruguay if a quota is imposed on cheese imports from the EU (Text F, paragraph [2]).

▶️Answer/Explanation

For a correct quota diagram with appropriate labelling, showing the quota, the rise in price and fall in quantity demanded AND for an explanation that the quota causes the price for consumers to rise and the quantity that they demand (or the consumer surplus) to decrease.

Question

Using an international trade diagram, explain the effect of removing tariffs on the imports of fertilizer into Cameroon (Text F).

▶️Answer/Explanation

For drawing a correctly labelled trade diagram, with a downward shift of the world (or UK and/or EU) supply curve, a decrease in price, and an increase in the level of imports AND for an explanation that removing the tariff will result in a decrease in the price of fertilizer and hence an increase in the quantity of imports due to an increase in the quantity demanded and/or decrease in the domestic quantity supplied.