IBDP Economics SL – The global economy – Economic growth and/or economic development strategies -Paper 2 Exam Style Practice Questions

Economic growth and/or economic development strategies Paper 2?

Exam Style Questions..

Subject Guide IBDP Economic IBO

IBDP Economic SL- All Topics

Exam Style Question for Economic growth and/or economic development strategies -Paper 2

Bhutan’s growth soars amid hydropower building boom

- Bhutan is a developing Asian country, bordered by India and China. The government of Bhutan is mostly interventionist in its approach to economic growth and economic development. Situated in the Himalayan mountains, Bhutan has significant water resources that may be employed to generate hydropower.

- The most significant intervention by the government is investment in the generation of hydropower. However, funding is not possible domestically. The hydropower projects are mostly financed by concessional long-term loans from India. Government borrowing to finance hydropower construction has made Bhutan the second-most indebted nation in Asia. Bhutan now has a high level of government debt, equal to 118 % of annual real gross domestic product (GDP).

- The funding of Bhutan’s interventionist policies has created significant dependence on Indian tied aid. A condition of the aid is that Indian companies lead the infrastructure projects. The large amount of foreign aid has made achieving self-reliance difficult. At present, India finances nearly one-quarter of the Bhutan government’s budget expenditures.

- When the projects are completed they will more than double Bhutan’s hydropower generation capacity and over 80 % of the power generated will be exported to India. Hydropower to India is Bhutan’s largest export, and the increased exports will lead to greater government revenue. Real GDP growth is expected to reach 11.7 % by 2019.

- Another significant intervention by the government is the promotion of university education for as many young people as possible, coupled with the creation of government jobs to employ them. The present level of exporting hydropower to India has provided some government revenue to pay for government jobs. However, while the number of university graduates is growing each year, the number of government jobs has not been growing at the same rate.

- In response to the current inability to provide enough jobs, the government is also implementing other programmes. Firstly, they are encouraging graduates to pursue employment in Bhutan’s small private sector, which is struggling to make a meaningful contribution to economic growth. Secondly, the government is promoting tourism, making it one of the most popular alternatives to government employment. Thirdly, the government is attempting to reduce red tape (excessive regulations) in areas such as industrial licensing, trade, labour markets and finance. This red tape is a barrier to foreign direct investment. Finally, the government is trying to make employment in agriculture more appealing. Bhutan’s climate means that it could be well-positioned to produce and export a variety of fruits.

Question

Define the term concessional long-term loans indicated in bold in the text (paragraph [2]).

▶️Answer/Explanation

For stating any two of the following:

- a form of aid (to finance development projects)

- very low (below market rate) or zero rate of interest

- repayments are stretched over a long time period (25 to 40 years)

- may include a grace period

- may be repayable in local currency.

Bhutan’s growth soars amid hydropower building boom

- Bhutan is a developing Asian country, bordered by India and China. The government of Bhutan is mostly interventionist in its approach to economic growth and economic development. Situated in the Himalayan mountains, Bhutan has significant water resources that may be employed to generate hydropower.

- The most significant intervention by the government is investment in the generation of hydropower. However, funding is not possible domestically. The hydropower projects are mostly financed by concessional long-term loans from India. Government borrowing to finance hydropower construction has made Bhutan the second-most indebted nation in Asia. Bhutan now has a high level of government debt, equal to 118 % of annual real gross domestic product (GDP).

- The funding of Bhutan’s interventionist policies has created significant dependence on Indian tied aid. A condition of the aid is that Indian companies lead the infrastructure projects. The large amount of foreign aid has made achieving self-reliance difficult. At present, India finances nearly one-quarter of the Bhutan government’s budget expenditures.

- When the projects are completed they will more than double Bhutan’s hydropower generation capacity and over 80 % of the power generated will be exported to India. Hydropower to India is Bhutan’s largest export, and the increased exports will lead to greater government revenue. Real GDP growth is expected to reach 11.7 % by 2019.

- Another significant intervention by the government is the promotion of university education for as many young people as possible, coupled with the creation of government jobs to employ them. The present level of exporting hydropower to India has provided some government revenue to pay for government jobs. However, while the number of university graduates is growing each year, the number of government jobs has not been growing at the same rate.

- In response to the current inability to provide enough jobs, the government is also implementing other programmes. Firstly, they are encouraging graduates to pursue employment in Bhutan’s small private sector, which is struggling to make a meaningful contribution to economic growth. Secondly, the government is promoting tourism, making it one of the most popular alternatives to government employment. Thirdly, the government is attempting to reduce red tape (excessive regulations) in areas such as industrial licensing, trade, labour markets and finance. This red tape is a barrier to foreign direct investment. Finally, the government is trying to make employment in agriculture more appealing. Bhutan’s climate means that it could be well-positioned to produce and export a variety of fruits.

Question

Explain two possible disadvantages for Bhutan in receiving India’s tied aid (paragraph [3]).

▶️Answer/Explanation

For an explanation of two disadvantages. Possible disadvantages of tied aid include:

- does not necessarily allow the purchase of the cheapest products

- may not be invested in a way that increases domestic supply may cause a decrease in domestic supply as imports compete with domestic production

- may not lead to increased employment opportunities

- may be using inferior quality material or labour being supplied by the donor country

- may limit choice

- may make Bhutan dependent on Indian imports

- may subject Bhutan to political exploitation by India

- may result in inappropriate technology being used.

Bhutan’s growth soars amid hydropower building boom

- Bhutan is a developing Asian country, bordered by India and China. The government of Bhutan is mostly interventionist in its approach to economic growth and economic development. Situated in the Himalayan mountains, Bhutan has significant water resources that may be employed to generate hydropower.

- The most significant intervention by the government is investment in the generation of hydropower. However, funding is not possible domestically. The hydropower projects are mostly financed by concessional long-term loans from India. Government borrowing to finance hydropower construction has made Bhutan the second-most indebted nation in Asia. Bhutan now has a high level of government debt, equal to 118 % of annual real gross domestic product (GDP).

- The funding of Bhutan’s interventionist policies has created significant dependence on Indian tied aid. A condition of the aid is that Indian companies lead the infrastructure projects. The large amount of foreign aid has made achieving self-reliance difficult. At present, India finances nearly one-quarter of the Bhutan government’s budget expenditures.

- When the projects are completed they will more than double Bhutan’s hydropower generation capacity and over 80 % of the power generated will be exported to India. Hydropower to India is Bhutan’s largest export, and the increased exports will lead to greater government revenue. Real GDP growth is expected to reach 11.7 % by 2019.

- Another significant intervention by the government is the promotion of university education for as many young people as possible, coupled with the creation of government jobs to employ them. The present level of exporting hydropower to India has provided some government revenue to pay for government jobs. However, while the number of university graduates is growing each year, the number of government jobs has not been growing at the same rate.

- In response to the current inability to provide enough jobs, the government is also implementing other programmes. Firstly, they are encouraging graduates to pursue employment in Bhutan’s small private sector, which is struggling to make a meaningful contribution to economic growth. Secondly, the government is promoting tourism, making it one of the most popular alternatives to government employment. Thirdly, the government is attempting to reduce red tape (excessive regulations) in areas such as industrial licensing, trade, labour markets and finance. This red tape is a barrier to foreign direct investment. Finally, the government is trying to make employment in agriculture more appealing. Bhutan’s climate means that it could be well-positioned to produce and export a variety of fruits.

Question

Using information from the text/data and your knowledge of economics, evaluate the government policies being used to promote economic development in Bhutan.

▶️Answer/Explanation

Responses may include:

- definition of economic development

- definition of any of the government policies mentioned in the discussion (interventionist supply-side policies, diversification, deregulation, etc).

Strengths of policies:

- may reduce market failure through the provision of hydroelectricity (paragraph [1])

- increased power supplies (paragraph [4])

- exploiting hydropower generates government revenue (paragraph [4])

- increasing export revenue, helping to achieve high GDP growth rates of 11.7 % (paragraph [4])

- number of university graduates is growing each year, supporting an increase in quality of labour (paragraph [5])

- creation of government jobs reduces unemployment (paragraph [5])

- government is promoting tourism which may diversify the economy away from over-reliance on hydroelectricity (paragraph [6])

- potential growth of private sector with more graduates (paragraph [6])

- promotion of tourism as an alternative to government employment (paragraph [6])

- deregulation leading to increased FDI (paragraph [6])

- promotion of agriculture as an alternative to government employment (paragraph [6]).

Limitations of policies:

- overdependence on India for funding, creating a significant government debt, 118 % of real GDP (paragraph [2])

- high debt means burden to future generations (paragraph [2])

- overdependence on tied aid and Indian companies leading the work (paragraph [3])

- the provision of government jobs may lead to crowding out in the private sector (paragraph [6])

- returns on investment in human capital may be muted if graduates leave the country due to the lack of employment opportunities (paragraph [5])

- emphasis on agriculture may result in limited growth opportunities for exports in the future, because in competition with many other economies and low income elasticities of demand for primary products.

Chinese investment helps Peru to develop

- Over the past decade, Peru has been one of South America’s fastest-growing economies, with an average economic growth rate of 5.9 % and low average annual inflation of 2.9 %. This has been mostly due to a favourable external environment, sensible macroeconomic policies and reforms of environmental regulations designed to increase investment in Peru’s profitable mining sector. However, the deregulation in the mining sector has been opposed by environmental groups and trade unions, fearing increased pollution and poorer working conditions.

- Strong growth in employment and income has dramatically reduced poverty rates. Absolute poverty fell from 27.6 % in 2005 to 9 % in 2015.

- Gross domestic product (GDP) growth continued to accelerate in 2016, very much helped by higher mining export output as several new large mining projects entered into production and reached full capacity. Peru mines and exports many commodities, including copper, gold, lead, zinc, tin, iron ore, silver, and oil and petroleum products.

- China is Peru’s main trading partner, taking 22.1 % of Peru’s exports and supplying 22.7 % of their imports in 2016. Chinese companies are also significant suppliers of foreign direct investment (FDI) to Peru, recently investing over US$2 billion to purchase a hydroelectric power plant. The second main trading partner is the United States (US), taking 15.2 % of Peru’s exports and supplying 20.7 % of their imports in 2016.

- Peru’s current account deficit declined significantly from 4.9 % to 2.8 % of GDP in 2016, owing to increasing export growth and lower imports. Peru’s government continues to support a free trade policy; since 2006, Peru has signed trade deals with 17 different countries including the US, Canada, China and Japan. In addition, a trade deal has also been signed with the European Union.

- Real GDP growth is expected to slow slightly in 2017 due to an anticipated lower growth rate in the mining sector and weak private investment. To support the economy as mining production slows, the government is expected to increase public investment in 2017.

- Growth projections may not be achieved if any, or a combination, of the following occur: external shocks in commodities prices, a further deceleration of China’s economic growth, unpredictability in world capital markets and the threat of tight monetary policy in the US. Raising economic growth requires structural and fiscal reforms to improve productivity, reduce the size of the informal sector and improve the efficiency of public services.

Question

Define the term foreign direct investment (FDI) indicated in bold in the text (paragraph [4]).

▶️Answer/Explanation

An explanation that it is any two of the following:

- long-term investment in another country

- investment by a multinational corporation (MNC)

- investment in another country representing at least 10% ownership

- investment in productive facilities.

Chinese investment helps Peru to develop

- Over the past decade, Peru has been one of South America’s fastest-growing economies, with an average economic growth rate of 5.9 % and low average annual inflation of 2.9 %. This has been mostly due to a favourable external environment, sensible macroeconomic policies and reforms of environmental regulations designed to increase investment in Peru’s profitable mining sector. However, the deregulation in the mining sector has been opposed by environmental groups and trade unions, fearing increased pollution and poorer working conditions.

- Strong growth in employment and income has dramatically reduced poverty rates. Absolute poverty fell from 27.6 % in 2005 to 9 % in 2015.

- Gross domestic product (GDP) growth continued to accelerate in 2016, very much helped by higher mining export output as several new large mining projects entered into production and reached full capacity. Peru mines and exports many commodities, including copper, gold, lead, zinc, tin, iron ore, silver, and oil and petroleum products.

- China is Peru’s main trading partner, taking 22.1 % of Peru’s exports and supplying 22.7 % of their imports in 2016. Chinese companies are also significant suppliers of foreign direct investment (FDI) to Peru, recently investing over US$2 billion to purchase a hydroelectric power plant. The second main trading partner is the United States (US), taking 15.2 % of Peru’s exports and supplying 20.7 % of their imports in 2016.

- Peru’s current account deficit declined significantly from 4.9 % to 2.8 % of GDP in 2016, owing to increasing export growth and lower imports. Peru’s government continues to support a free trade policy; since 2006, Peru has signed trade deals with 17 different countries including the US, Canada, China and Japan. In addition, a trade deal has also been signed with the European Union.

- Real GDP growth is expected to slow slightly in 2017 due to an anticipated lower growth rate in the mining sector and weak private investment. To support the economy as mining production slows, the government is expected to increase public investment in 2017.

- Growth projections may not be achieved if any, or a combination, of the following occur: external shocks in commodities prices, a further deceleration of China’s economic growth, unpredictability in world capital markets and the threat of tight monetary policy in the US. Raising economic growth requires structural and fiscal reforms to improve productivity, reduce the size of the informal sector and improve the efficiency of public services.

Question

Explain two reasons why Chinese companies may have been attracted into Peru (paragraph [4]).

▶️Answer/Explanation

For explaining any two of the following reasons:

- sensible macroeconomic policies promote a stable business environment

- reforms of environmental regulations designed to increase investment

- rising employment and/or income increases the potential sales of Chinese Companies

- Peru’s government is expected to increase public investment, making it easier for Chinese companies to move goods and resources, reducing costs

- low political risk reduces uncertainty and promotes a stable business environment

- access for Chinese companies to geographically-specific resources to increase production

- lower wages of workers.

hinese investment helps Peru to develop

- Over the past decade, Peru has been one of South America’s fastest-growing economies, with an average economic growth rate of 5.9 % and low average annual inflation of 2.9 %. This has been mostly due to a favourable external environment, sensible macroeconomic policies and reforms of environmental regulations designed to increase investment in Peru’s profitable mining sector. However, the deregulation in the mining sector has been opposed by environmental groups and trade unions, fearing increased pollution and poorer working conditions.

- Strong growth in employment and income has dramatically reduced poverty rates. Absolute poverty fell from 27.6 % in 2005 to 9 % in 2015.

- Gross domestic product (GDP) growth continued to accelerate in 2016, very much helped by higher mining export output as several new large mining projects entered into production and reached full capacity. Peru mines and exports many commodities, including copper, gold, lead, zinc, tin, iron ore, silver, and oil and petroleum products.

- China is Peru’s main trading partner, taking 22.1 % of Peru’s exports and supplying 22.7 % of their imports in 2016. Chinese companies are also significant suppliers of foreign direct investment (FDI) to Peru, recently investing over US$2 billion to purchase a hydroelectric power plant. The second main trading partner is the United States (US), taking 15.2 % of Peru’s exports and supplying 20.7 % of their imports in 2016.

- Peru’s current account deficit declined significantly from 4.9 % to 2.8 % of GDP in 2016, owing to increasing export growth and lower imports. Peru’s government continues to support a free trade policy; since 2006, Peru has signed trade deals with 17 different countries including the US, Canada, China and Japan. In addition, a trade deal has also been signed with the European Union.

- Real GDP growth is expected to slow slightly in 2017 due to an anticipated lower growth rate in the mining sector and weak private investment. To support the economy as mining production slows, the government is expected to increase public investment in 2017.

- Growth projections may not be achieved if any, or a combination, of the following occur: external shocks in commodities prices, a further deceleration of China’s economic growth, unpredictability in world capital markets and the threat of tight monetary policy in the US. Raising economic growth requires structural and fiscal reforms to improve productivity, reduce the size of the informal sector and improve the efficiency of public services.

Question

Using information from the text/data and your knowledge of economics, evaluate the factors that may allow Peru to continue to achieve high rates of economic growth in the future.

▶️Answer/Explanation

Responses may include:

- definition of economic growth.

Factors affecting economic growth:

- deregulation should increase investment (paragraph [1]) and so will lead to an increase in AD and thus economic growth, however, there are the dangers of pollution and poorer working conditions (paragraph [1])

- growth could be limited if loose environmental regulations cause, for example, pollution that harms health and therefore workers’ productivity (paragraph [1])

- growth in employment and income (paragraph [2]) should lead to increases in consumption and so AD, however, this will only continue if the economy keeps growing

- higher mining export volumes (paragraph [3]) should continue to provide economic growth, however, this will be dependent on continued growth in the global economy

- FDI (paragraph [4]) could fill the investment gap, shifting AD and increasing economic growth, however, FDI has several negative aspects and its continuation will be dependent on the situation in the economies providing it, eg “deceleration of China’s economic growth (paragraph [7])

- free trade (paragraph [5]), with continued trade surpluses, will provide continued economic growth, but is once again dependent on the state of the world economy and on the trade policies of other countries

- increased public investment (paragraph [6]) should create economic growth, but will it be enough to outweigh “the lower growth rate in the mining sector and weak private investment” (paragraph [6])

- external shocks in commodities prices (paragraph [7]) could negatively affect future export earnings

- a further deceleration of China’s economic growth (paragraph [7]) could affect demand for commodities from the main trading partner and FDI (paragraph [4])

- unpredictability in world capital markets (paragraph [7]) could affect investment

- the threat of tight (contractionary) monetary policy in the US (paragraph [7]) could lead to a slowdown in the US economy and hence reduce the demand for commodities from the second main trading partner (paragraph [4])

- tight (contractionary) monetary policy in the US (paragraph [7]) could lead to an outflow of savings to the US, reducing funds available for investment in Peru.

Pakistan and the International Monetary Fund

- Pakistan is a low-income country with a rapidly growing population and widespread poverty. As of 2019, it has a large budget deficit due to high levels of military spending and high costs of debt servicing (35 % of the deficit is interest payments). It is also experiencing a widening current account deficit and is heavily dependent on foreign aid.

- Pakistan’s government is negotiating a loan from the International Monetary Fund (IMF). Amongst its conditions, the IMF has said that the government must decrease private-sector regulation such as regulations on financial institutions. The government must also sell state-owned enterprises and government revenue must be raised by increasing indirect taxes and improving tax collection systems. Furthermore, the IMF insists that the government cuts its spending further.

- The government has stated that the IMF loan is essential to restore confidence in Pakistan’s economy. This would help to attract foreign direct investment (FDI) to encourage economic growth and help break out of the poverty cycle. High debt levels and slowing economic growth in 2018 discouraged FDI. The IMF loan is also needed to help persuade other multilateral lenders such as the World Bank and the Asian Development Bank to provide and extend loans.

- In the past, Pakistan has had 21 agreements with the IMF with limited success—any balance of payments or external debt improvement has been temporary. The IMF states that this is because Pakistan has not always met the conditions of the loans, while other stakeholders argue it was the lack of support given to Pakistan to implement the conditions and to allocate the loan funds appropriately.

- Economists say that there needs to be a focus on improving human capital to provide the large number of young people entering the labour force with the skills to grow businesses. The quality of education needs to improve and to be combined with an effort to provide girls with greater access to education—female participation in the labour force is the lowest in the region.

- The World Bank has financed education and infrastructure, such as renewable energy projects, in poor regions of Pakistan. However, critics of the World Bank argue that the projects are not making a significant difference and the construction of hydroelectric dams leads to environmental damage.

- The government believes that the macroeconomic concerns of the IMF should be addressed first, and poverty issues in Pakistan can be dealt with later.

Question

State two functions of the International Monetary Fund (IMF) (paragraph [2]).

▶️Answer/Explanation

Any two of the following:

- oversee/monitor the stability of the international monetary system

- promote international monetary cooperation

Pakistan and the International Monetary Fund

- Pakistan is a low-income country with a rapidly growing population and widespread poverty. As of 2019, it has a large budget deficit due to high levels of military spending and high costs of debt servicing (35 % of the deficit is interest payments). It is also experiencing a widening current account deficit and is heavily dependent on foreign aid.

- Pakistan’s government is negotiating a loan from the International Monetary Fund (IMF). Amongst its conditions, the IMF has said that the government must decrease private-sector regulation such as regulations on financial institutions. The government must also sell state-owned enterprises and government revenue must be raised by increasing indirect taxes and improving tax collection systems. Furthermore, the IMF insists that the government cuts its spending further.

- The government has stated that the IMF loan is essential to restore confidence in Pakistan’s economy. This would help to attract foreign direct investment (FDI) to encourage economic growth and help break out of the poverty cycle. High debt levels and slowing economic growth in 2018 discouraged FDI. The IMF loan is also needed to help persuade other multilateral lenders such as the World Bank and the Asian Development Bank to provide and extend loans.

- In the past, Pakistan has had 21 agreements with the IMF with limited success—any balance of payments or external debt improvement has been temporary. The IMF states that this is because Pakistan has not always met the conditions of the loans, while other stakeholders argue it was the lack of support given to Pakistan to implement the conditions and to allocate the loan funds appropriately.

- Economists say that there needs to be a focus on improving human capital to provide the large number of young people entering the labour force with the skills to grow businesses. The quality of education needs to improve and to be combined with an effort to provide girls with greater access to education—female participation in the labour force is the lowest in the region.

- The World Bank has financed education and infrastructure, such as renewable energy projects, in poor regions of Pakistan. However, critics of the World Bank argue that the projects are not making a significant difference and the construction of hydroelectric dams leads to environmental damage.

- The government believes that the macroeconomic concerns of the IMF should be addressed first, and poverty issues in Pakistan can be dealt with later.

Question

Using information from the text/data and your knowledge of economics, evaluate the potential impact of the IMF and the World Bank on economic development in Pakistan.

▶️Answer/Explanation

Responses may include:

- Functions of IMF, World Bank.

- Definition of economic development.

- The difference between the IMF and the World Bank.

May promote/achieve economic development because:

- IMF loans provide help with balance of payments deficit and external debt obligations (paragraph [1]), allows government revenue to be used for improving quality of life through expenditure on merit goods.

- The IMF may learn from previous agreements and provide the monitoring/support needed for successful implementation of realistic conditions to reduce the burden of debt payments (paragraph [4]).

- Other potential lenders may be persuaded or given the confidence to provide finance to help with economic development projects (paragraph [3]).

- The World Bank’s education projects directly influence education and female enrolment rates which promote gender equality, employment possibilities, increasing incomes and access to basic needs (paragraph [5]).

- Providing key infrastructure such as hydroelectric dams allows access to electricity and provides basic needs and infrastructure for business development (paragraph [6]).

- Loans help build capacity and attract FDI to facilitate economic growth needed to break out of the poverty cycle (paragraph [3]), may provide employment opportunities and increased tax revenue.

- IMF suggestions/conditions such as improved tax collection and access to credit can help support economic development (paragraph [2]).

Above points should link to how these impacts will reduce poverty, increase living standards, reduce income inequalities and/or increase employment opportunities, improve health and education indicators, ie achieve economic development.

However, may not promote economic development because:

- Loan conditions (paragraph [2]) may limit the government’s ability to achieve its development objectives, particularly the improvement in human capital (paragraph [5]).

- Development spending might be decreased due to contractionary fiscal policy.

- Balance of payments issue has not been dealt with in the past (paragraph [4]).

- World Bank infrastructure project – may lack sustainability (paragraph [6]).

- The lending conditions may reduce economic growth, increase unemployment and hamper economic development.

- While FDI may lead to increased employment and economic growth, attracting FDI may require offering concessions (tax, regulatory, etc) which may limit its development impact.

- More loans and extending loans (paragraph [3]) may not be dealing with other fundamental issues of managing the loans, such as servicing costs (paragraph [4]).

- Environmental issues may be overlooked, threatening sustainability (paragraph [6]).

Trade strategies in the Philippines

- For more than 20 years the Philippines has been limiting the volume of rice it imports. However, the agreement with the World Trade Organization (WTO) that permitted these restrictions expired in 2017. In early 2019, the government replaced the quantity restrictions with tariff protection. A 35% tariff on imported rice from the Association of Southeast Asian Nations (ASEAN)* was imposed to protect the domestic rice industry in the Philippines. Following the replacement of the quota with a tariff, rice prices are expected to fall significantly. However, urban households want the president to allow rice to be imported without any tariffs to reduce food bills even further.

- The poorest quintile of households in the Philippines consumes nearly twice as much ordinary rice and 20 times more National Food Authority (NFA) rice compared to the richest quintile. Rising food prices are pushing up inflation as a result of increasing salaries in urban areas. The daily minimum wage in Manila, the Philippine capital, will increase by 4.9 %, the highest hike in six years, to the equivalent of US$10.11. Farming and fishing provide the livelihoods for around one-third of the labour force in the Philippines. Land reform programmes are slowly being implemented to change the current situation of unfair ownership of land and resources by a few individuals. However, uncertainty continues to discourage investment in adequate irrigation systems in the countryside. As an agricultural country, irrigation in the Philippines is very important. Improvements in the quality of infrastructure services will help cut the cost of doing business, attract more investment, and enhance productivity around the country. Food manufacturing, including food and beverage processing, remains the most dominant primary industry in the Philippines. This has become a focus in the hope of increasing farm incomes, because this part of the economy is currently dominated by big international companies. Major exports of processed fruits and nuts include mangos, pineapples, bananas and peanuts.

- The Philippine Export Development Plan (PEDP) 2018–2022 calls for boosting the export of services, increasing export competitiveness, and exploring new markets. Efforts have already been made to harmonize the country’s standards, testing, certification and quality accreditation of products to improve trade and comply with standards in the European Union. The PEDP aims to increase the volume and value of exports by encouraging investment in production processes and supply chains. Another strategy to achieve the plan’s objective is to exploit existing and new opportunities from trade agreements.

- The Philippines lacks the infrastructure needed to attract export-oriented manufacturing. To support the PEDP, the government needs to increase its spending on new airports, roads and bridges. These public works are critical to boosting the incomes of people in poorer areas by connecting them better to Manila. To allow for this extra spending, a series of tax reforms was started: the income tax for the highest income earners has been raised from 30 % to 35 %, and indirect taxes have been increased.

Question

Using information from the text/data and your knowledge of economics, evaluate the use of export promotion as a means of achieving economic development in the Philippines.

▶️Answer/Explanation

Answers may include:

- Definitions of economic development, export promotion.

- The link between export-led growth and economic development.

Advantages of export promotion may include:

- The PEDP 2017–2022 wants to boost the export of services, which could bring in more export revenue due to its higher value, increasing incomes of workers in numerous services, allowing for a better standard of living and higher tax revenue for the government (paragraph [3]).

- Increased exports of processed foods rather than unprocessed foods will increase farm incomes (paragraph [2]).

- If boosting exports and increasing export competitiveness (such as the standards, testing and certification) is successful, then more export revenue should come in (paragraph [3]), providing the government with more tax revenue which could be spent on development objectives.

- Removing regulations should make it easier for exporters to run their business and to export their products (paragraph [3]).

- Investment in the production processes and supply chains (paragraph [3]) should reduce the costs of production over time and make the goods more export competitive.

- Exploiting existing and new opportunities from trade agreements (paragraph [3]) should increase export revenues in sectors that are competitive.

- If more is exported, then more can be imported and the tariffs on rice can be lowered, benefitting low-income families (paragraph [1]).

Disadvantages/limitations of export promotion may include:

- Export promotion could favour economic activities in urban areas which could lead to higher prices and wages in these areas, especially in Manila (paragraph [2]); higher domestic prices and inflation, affecting all families negatively as real incomes and purchasing power falls, and therefore lower income families are most negatively affected, lowering standards of living, and possibly increasing inequality and poverty.

- Export promotion will be difficult to achieve when investment in much-needed irrigation systems that would improve productivity in farming as well as infrastructure to help farmers connect to export markets, is discouraged (paragraph [2]).

- There is a lack of access to export markets due to the lack of infrastructure, which would also hamper export promotion.

- The Philippines lacks the infrastructure needed to attract export-oriented manufacturing (paragraph [4]) from overseas.

- Other countries may resist increased exports from the Philippines.

- Reliance on a narrow range of exports (such as processed food) may be risky.

- More will be spent on infrastructure by the government. Although the budget may have more income from an increase in income tax, poorer households may suffer due to a higher indirect tax on a range of goods (paragraph [4]).

Angola’s economic reforms

- Following an oil price crash in 2014, Angola has endured a recession, a dramatic rise in inflation and empty supermarket shelves caused by severe shortages of foreign currency. Angola is highly dependent on export revenues from oil production, a major source of United States dollars. The foreign currency is needed to import manufactured goods because the country’s manufacturing sector is small.

- To respond to these challenges, the president of Angola has presented a plan with desperately needed reforms to promote economic development. The plan proposes tax incentives to attract foreign investment and privatization of the telecommunication and railway sectors. It also aims to expand infrastructure projects with private sector involvement. In addition, reforms are recommended to make the banking sector stronger. This is important if the government wants to reduce the borrowing costs experienced by Angolan businesses.

- The recent 20 % devaluation of the kwanza (Angola’s currency) is another sign that the government is serious about making Angola attractive to foreign direct investment (FDI). Angola has a fixed exchange rate. As the kwanza has been overvalued, this has caused a reduction in foreign currency reserves.

- Angola’s future economic growth is likely to be low. The business environment for firms remains difficult. High borrowing costs, corruption and poor infrastructure remain challenges. The government has failed to exploit Angola’s vast agricultural potential. The country depends heavily on oil revenues, which are falling.

- Living conditions for households are also poor as inflation is expected to remain above 25 %. Approximately 40 % of Angolans live in absolute poverty and unemployment is high, especially in rural areas. Aware of the urgent need to reduce regional inequality, the government has announced plans to encourage investment in rural areas. However, there are also proposals to reduce public debt by removing some subsidies on food and by introducing ad valorem taxes.

- Although Angola’s economic growth has been slow, it remains the third-largest economy in sub-Saharan Africa and the government is the second-largest public spender in the region.

Question

Using information from the text/data and your knowledge of economics, evaluate the effectiveness of market-oriented policies in achieving economic development in Angola.

▶️Answer/Explanation

Answers may include:

- Definition of market-oriented policies

- Definition of economic development.

Strengths of market-oriented policies:

- Promotes growth and creates employment and possibly higher wages by attracting foreign investment (paragraph [2])

- Devaluing the exchange rate has reduced the need for foreign exchange reserves (paragraph [3])

- Privatization may lead to competition, lower costs and lower prices and more choice for consumers (paragraph [2])

- Privatization will provide revenue to the government to pay down debt or invest in infrastructure and/or social spending

- Expanding infrastructure projects with private sector involvement encourage FDI (paragraph [2])

- Market-oriented policies may increase long run aggregate supply allowing inflation to fall below 25 % (paragraph [5])

- Tax incentives in rural areas would create jobs and reduce inequalities (paragraph [5])

- Reforms of the banking sector will possibly make it easier for small-scale businesses to get loans (paragraph [2]).

Limitations of market-oriented policies:

- The privatization of railways and telecommunications may lead to higher prices for consumers and more inequality

- Incentive-based policies may not be sufficient to allow for diversification since manufacturing base is small and likely underdeveloped (paragraph [1] and [4])

- Stopping subsidies on food and using ad valorem taxes will raise prices causing inflation and inequality to worsen in the short term (paragraph [5])

- Measures to reduce public debt could worsen income inequality

- Market-oriented policies (e.g. more inward FDI) are unlikely to work without complementary interventionist policies such as the building of infrastructure (paragraph [4]) to support diversification

- Less intervention in the exchange rate may lead to depreciation and higher prices and/or less certainty for foreign investors

- Market-oriented policies may lead to externalities

- Encouraging more inward FDI and other investment will increase private sector debts and debt-servicing costs, leading to less income available to spend on merit goods

- Market-oriented policies tend to lead to higher inequalities (e.g. through lower wages).

Coffee production in Honduras

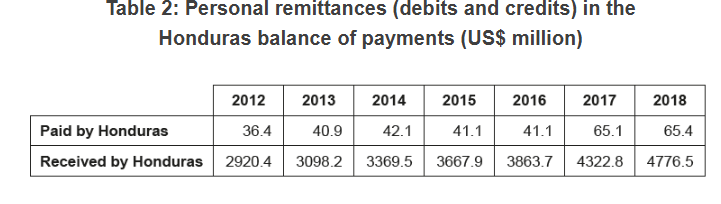

- Coffee farmers in Honduras, Central America, are struggling to earn enough revenue to cover production costs. Some have left their farms and migrated to the United States (US). Many remaining families depend on remittances (money sent by a foreign worker to their home country) from relatives in the US.

- The agricultural sector, which employs about 28 % of the labour force in Honduras and accounts for 45 % of gross domestic product (GDP), has always faced difficulties and has had very little government support. Fluctuations in international commodity prices are also a problem. The average global price of a 60 kg bag of coffee beans dropped from US$140 in 2017 to US$62 in 2019, because countries such as Vietnam, Indonesia and Ethiopia increased their exports.

- Scientists say that the greatest threat to crops comes from global warming. The World Bank has estimated that over the next 30 years climate change could force around 1.4 million people to leave Central America for the US. Meanwhile, global warming is partly blamed on the US continuing to operate coal-fired power plants, which account for about 30 % of its electricity generation.

- Rising temperatures and uncertain weather have affected plant growth, ruined harvests and led to pests and diseases. The amount of land suitable for growing coffee, which is Honduras’s most important agricultural export, will probably fall by over 40 % before 2050. Already, the number of coffee producers has declined by 25 % in some areas. Furthermore, reduced yields of subsistence crops like corn and beans could significantly increase malnutrition.

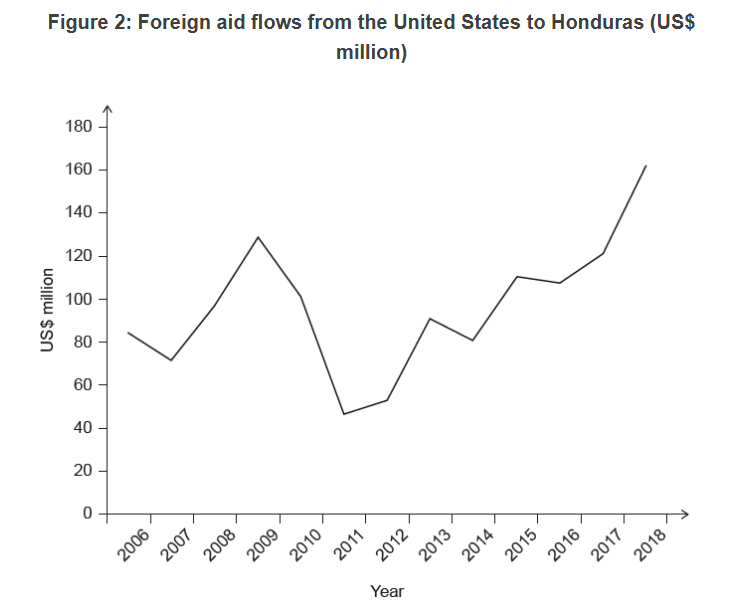

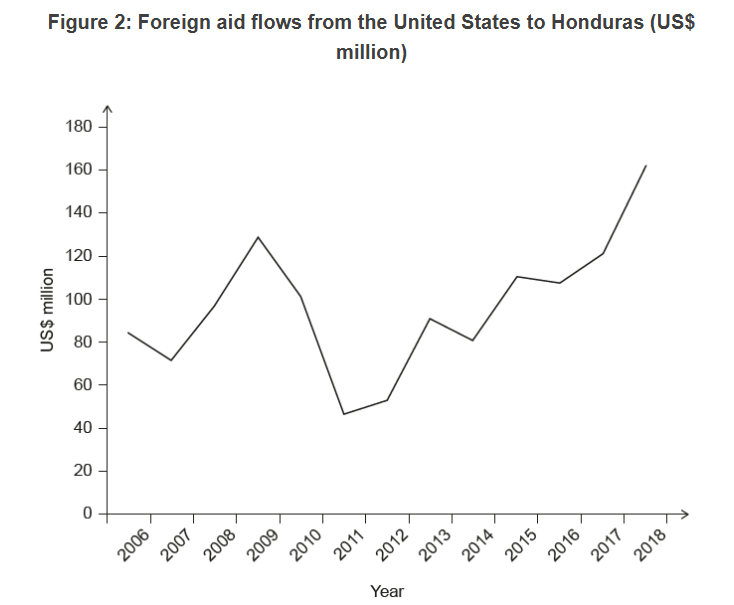

- Foreign aid from the US includes humanitarian aid and grants to non-governmental organizations (NGOs) that have projects helping farmers adapt to climate change. However, the US administration has threatened to stop all foreign aid to Central America, claiming that its governments are failing to reduce the flow of migrants to the US. Between 2016 and 2019, the total annual aid budget for Central America had already dropped from US$750 million to US$530 million. The biggest reductions were in projects assisting rural economies and agriculture, while there was a small increase in funds for drug control and border enforcement, in order to reduce the number of migrants to the US.

- There is concern among local coffee growers that if aid is stopped there will be more unemployment, leading to more migration and abandoned farms.

- NGOs are helping coffee farmers to cope better with droughts and to diversify into other crops, such as avocados or timber. Global coffee sellers, including Starbucks, are supporting some projects in the hope that they can ensure the future supply of coffee. However, coffee farming in Honduras may never be profitable again.

Question

List two functions of the World Bank (paragraph [3])

▶️Answer/Explanation

A clear understanding is demonstrated by listing two of the following functions of the World Bank:

- gives loans to developing countries

- aims to promote development/restructuring

- aims to reduce poverty

- helps countries achieve the Millennium/Sustainable Development Goals

- provides technical assistance and advice

- supports foreign direct investment (FDI)

- collects data/does research.

Coffee production in Honduras

- Coffee farmers in Honduras, Central America, are struggling to earn enough revenue to cover production costs. Some have left their farms and migrated to the United States (US). Many remaining families depend on remittances (money sent by a foreign worker to their home country) from relatives in the US.

- The agricultural sector, which employs about 28 % of the labour force in Honduras and accounts for 45 % of gross domestic product (GDP), has always faced difficulties and has had very little government support. Fluctuations in international commodity prices are also a problem. The average global price of a 60 kg bag of coffee beans dropped from US\($\)140 in 2017 to US\($\)62 in 2019, because countries such as Vietnam, Indonesia and Ethiopia increased their exports.

- Scientists say that the greatest threat to crops comes from global warming. The World Bank has estimated that over the next 30 years climate change could force around 1.4 million people to leave Central America for the US. Meanwhile, global warming is partly blamed on the US continuing to operate coal-fired power plants, which account for about 30 % of its electricity generation.

- Rising temperatures and uncertain weather have affected plant growth, ruined harvests and led to pests and diseases. The amount of land suitable for growing coffee, which is Honduras’s most important agricultural export, will probably fall by over 40 % before 2050. Already, the number of coffee producers has declined by 25 % in some areas. Furthermore, reduced yields of subsistence crops like corn and beans could significantly increase malnutrition.

- Foreign aid from the US includes humanitarian aid and grants to non-governmental organizations (NGOs) that have projects helping farmers adapt to climate change. However, the US administration has threatened to stop all foreign aid to Central America, claiming that its governments are failing to reduce the flow of migrants to the US. Between 2016 and 2019, the total annual aid budget for Central America had already dropped from US\($\)750 million to US\($\)530 million. The biggest reductions were in projects assisting rural economies and agriculture, while there was a small increase in funds for drug control and border enforcement, in order to reduce the number of migrants to the US.

- There is concern among local coffee growers that if aid is stopped there will be more unemployment, leading to more migration and abandoned farms.

- NGOs are helping coffee farmers to cope better with droughts and to diversify into other crops, such as avocados or timber. Global coffee sellers, including Starbucks, are supporting some projects in the hope that they can ensure the future supply of coffee. However, coffee farming in Honduras may never be profitable again.

Question

Using information from the text/data and your knowledge of economics, discuss the extent to which foreign aid from the US may assist economic development in Honduras.

▶️Answer/Explanation

Answers may include:

- definitions of aid, ODA (official development assistance), development.

Benefits of aid may include:

- needed for development because the government is not providing enough support (paragraph [2])

- EMDCs should provide aid because the impact of climate change (for which they are mainly responsible) falls more heavily on ELDCs and hampers their development (paragraph [3] or [4])

- can provide help in adapting to climate change (paragraph [5])

- project aid can increase employment/incomes and reduce the number of migrants (paragraph [6])

- humanitarian aid helps to prevent malnutrition which lowers productivity (paragraph [4] or [5])

- joint projects with NGOs and/or private sector firms can be effective (paragraph [5] or [7])

- funds from aid can break the poverty cycle

- loans are usually concessional and therefore repayments are less which means that there is more government expenditure available for development projects.

Limitations of aid may include:

- aid flows can be volatile and unreliable (Figure 2)

- aid is influenced by political considerations (paragraph [5])

- aid (tied) is sometimes directed towards military and policing projects rather than to reducing poverty (paragraph [5])

- remittances from migrants are much larger and can be of more direct use to families (Table 2, paragraph [1])

- assistance from NGOs may be more effective and reliable (paragraph [7])

- the coffee processors and retailers such as Starbucks may provide more useful assistance (paragraph [7])

- aid funds may be misused if there is not good governance (paragraph [2]).