IBDP Economics SL – The global economy – Balance of payments -Paper 2 Exam Style Practice Questions

Balance of payments Paper 2?

Exam Style Questions..

Subject Guide IBDP Economic IBO

IBDP Economic SL- All Topics

Exam Style Question for Balance of payments -Paper 2

South Africa’s grain millers oppose corn tariff

- A battle is taking place between South African corn farmers and the corn millers who process corn. Grain South Africa (Grain SA) is the organization that represents the interests of corn farmers. It has asked the country’s International Trade Administration Commission (ITAC) to protect local corn farmers from low global corn prices by imposing a tariff on corn imports.

- South Africa’s corn millers are opposing the request by Grain SA to implement the tariff on corn imports. The corn millers argue that a tariff will cause a burden for consumers and cattle farmers. In South Africa, corn is an essential food and also a source of feed for livestock.

- According to Reuters news service, South Africa is “Africa’s largest corn producer and is relied upon by neighboring Sub-Saharan nations to [reinforce] their own corn supplies and feed their people.” A drought in South Africa has dramatically increased the price of corn. In addition, the reduced supply has prompted the need for imports. “South Africa [has traditionally been] a net exporter of corn … [but] for the second year in a row, [the economy] will become a net importer of corn.” The need to import corn has shocked both the corn farmers and the government.

- The United States (US) is the world’s largest corn producer. An unusually large harvest has increased US supply and more than halved the price of US corn to its current price of US$145 a ton. However, in South Africa, because of the drought, prices for domestically produced corn have more than doubled to reach an all-time high of US\($\)348 a ton. The low import prices of US corn have made it very difficult for South African corn farmers to earn sufficient income to survive the drought, which is why they have asked ITAC for protection.

- However, a spokesperson for the corn millers said “we are strongly opposed to any attempt to apply a tariff. Why do we need protection for a commodity in which we are so self-sufficient?” However, Grain SA have claimed that corn farmers cannot compete with the big corn-exporting countries, such as the US and Mexico, because their governments are subsidizing corn farmers. According to Grain SA, South African farmers get almost no assistance. This is why they have requested that ITAC implement the tariff to protect corn farmers from these unfair trade practices.

- According to economists, South Africa will probably need to import about 970 000 tons of corn this year and a further 3.8 million tons in the following 12 months. To make matters worse, the rand (South Africa’s currency) has experienced a sharp depreciation against the US dollar. Combined, the need to import corn and the depreciation are likely to negatively impact South Africa’s current account.

Question

Define the term current account indicated in bold in the text (paragraph [6]).

▶️Answer/Explanation

An explanation that it is a measure of (the net flow of funds from) trade in goods and services (exports and imports), income and transfers

Bank of Canada raises interest rates for the first time in seven years

- For seven years Canada’s central bank, the Bank of Canada, kept its official interest rate at 0.5 %. This period of easy monetary policy may be coming to an end. The Bank of Canada has just raised its official interest rate from 0.5 % to 0.75 %, claiming that there is new confidence in the Canadian economy. Figures show that the 3.5 % growth in gross domestic product (GDP) in the first quarter of 2017 is above its potential. In addition, the Bank of Canada expects growth in consumer spending, exports and business investment to stimulate economic growth in the months ahead. Such factors might contribute to inflationary pressure in the future.

- One of the issues that might have delayed the interest rate increase in Canada is that the inflation rate is still low and falling. Central banks typically raise interest rates when inflation is rising. That is not the problem in Canada, where the consumer price index (CPI) has been rising at well below the Bank of Canada’s 2 % inflation target. However, the governor of the Bank of Canada says that he is looking at forecasts of future inflation rates, noting that the data suggest the interest rate increase is necessary. An official statement from the Bank of Canada notes that growth is increasing across all industries and regions and that the economy has started to improve. There is no longer a need for the low interest rate.

- Positive economic growth figures, the optimism shown by the Bank of Canada, and the recent interest rate increase have caused a rapid appreciation of the Canadian dollar against the United States (US) dollar over recent months. There are now expectations that the Bank of Canada will raise the interest rate once or possibly twice more before the end of the year, as signs continue to point to a healthy economy. This would likely cause further strengthening of the Canadian dollar against the US dollar.

- An economist has said that the gain in the Canadian dollar against the US dollar may have a large effect on importers and exporters, although it will likely be months before consumers see the effects. She further noted that the effects would vary across different industries. There is some concern about the consequences for the Canadian current account. Currently the current account deficit is at 3.6 % of GDP.

- A stronger currency is also likely to encourage more Canadians to travel south to the US.

Question

Define the term current account deficit indicated in bold in the text (paragraph [4]).

▶️Answer/Explanation

An understanding that it is when the balance on the current account, which measures the net value of trade of goods and services, net income flows and net transfers, is negative.

South Korea’s exchange rate and central bank intervention

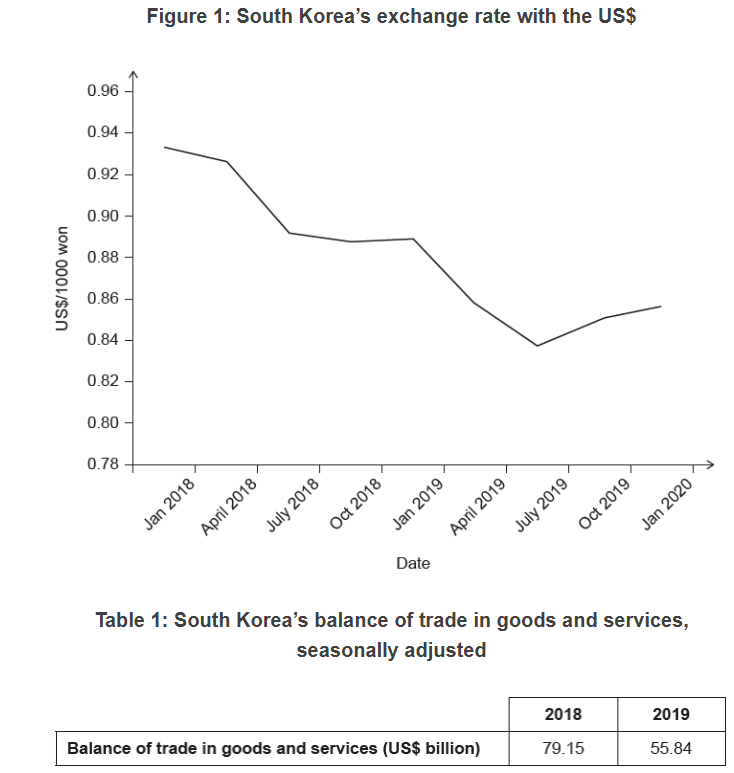

- From mid-2017 until mid-2019, there was a downward trend in the exchange rate of the South Korean won (South Korea’s currency), and some commentators suggested that it was being deliberately undervalued. Despite the lower exchange rate, however, the value of South Korean exports declined by 10.3 % during 2019.

- The main reason for the decline in the value of exports was the weak market for semiconductors. Lower global prices of semiconductors, the largest single export item for South Korea, led to a drop of 25.9 % in the value of exports, despite an increase in their volume. Evidently, price competitiveness of exports from South Korea is not as significant as before, because its exports are now mainly luxury or high-technology items.

- In November 2019, South Korea’s current account surplus reached US\($\)5.97 billion, more than 4 % of gross domestic product (GDP). The financial account in the balance of payments had a net outflow of US \($\)5.34 billion, which was mainly due to a net outflow of US\($\)4.01 billion in foreign direct investment (FDI). There was also a net outflow of US\($\)1.07 billion in portfolio investment, because domestic residents increased their financial assets overseas while inward flows declined.

- The Bank of Korea (South Korea’s central bank, BoK) had reduced interest rates to record lows in October 2019, which partly accounted for the large portfolio investment outflows. Monetary policy is likely to continue to be expansionary through 2020, with the possibility of another interest rate reduction, because economic growth is forecast to be low, at less than 2.5 %. The forecast for inflation is that it will be below 1.5 %, while the unemployment rate is expected to continue to rise to over 4 %.

- While the BoK is not targeting a specific level for the exchange rate, it seems determined to intervene when the market is unstable. Its actions, however, have contributed to South Korea being accused by the United States (US) of changing the value of its currency to gain an export advantage. If the US concludes that South Korea has been manipulating its exchange rate unfairly, it could impose trade barriers on imports from South Korea.

- However, through the last six months of 2019, the South Korean won started to rise against the US dollar (US$). The appreciation was partly due to speculation and expectations of a rise in demand for semiconductors. Moreover, in August 2019, the BoK sold US dollars in order to prevent the South Korean won from depreciating again. Overall, the central bank’s foreign exchange intervention has been aimed at restraining the South Korean won’s depreciation or stabilizing the market rather than at trying to promote exports.

Question

List two responsibilities of a central bank (paragraph [4]).

▶️Answer/Explanation

Two of the following responsibilities are listed:

- regulator of commercial banks

- banker to the government

- control of interest rates

- control of money supply

- implement monetary policy

- maintenance of price stability

- control of exchange rate policy

- provider and printer of notes and coins.

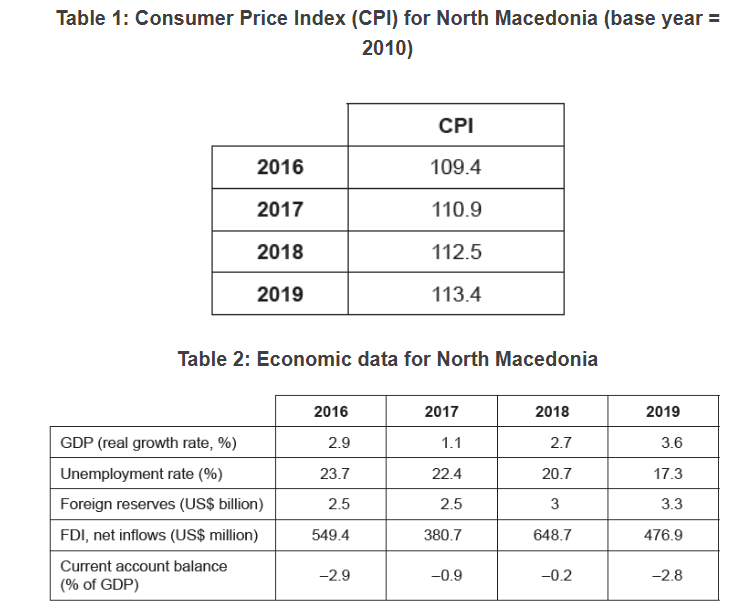

Text A — Overview of North Macedonia

- North Macedonia is a small, landlocked nation that shares borders with five countries, including Bulgaria and Greece. Bulgaria and Greece are members of the European Union (EU) common market, which North Macedonia hopes to join soon. Since the country began negotiating for EU membership, trade with the EU has increased rapidly and now accounts for 75 % of North Macedonia’s exports and 62 % of its imports.

- Despite its small market, with a population of approximately 2 million, North Macedonia’s proximity to the EU, low wages and expected entry into the common market have attracted foreign investors. Greece, its richest neighbour, was its third highest source of foreign investment in 2019. The lower cost of living also appeals to Greek tourists.

- EU companies have invested in the financial, telecommunication, energy and food processing industries in North Macedonia. Many of the most profitable companies are from the EU. If EU membership is granted, foreign direct investment (FDI) inflows may increase as firms located in North Macedonia will be allowed to bypass all custom checks and enjoy tariff-free trade within the common market. One particular challenge for North Macedonia, however, is that most of the profits of foreign companies are likely to be repatriated (sent back to the companies’ home countries).

- In 2018, North Macedonia’s export revenue was US\($\)7.57 billion and its import expenditure was US\($\)9.56 billion. The country’s main exports are iron and steel, clothing and accessories, and food products. Food, livestock and consumer goods account for 33 % of imports while the remainder are machinery, petroleum and other materials needed for the industrial production process.

- The manufacturing sector, which now employs 31 % of the labour force, has gained more importance. The agricultural sector remains strong, contributes over 10 % of North Macedonia’s gross domestic product (GDP) and employs about 16 % of the country’s workforce.

- The unemployment rate decreased from over 30 % in 2010 to 17.3 % in 2019. However, youth unemployment is almost 40 %. Over 20 % of the population lives below the poverty line. Unemployment and poverty contribute to high rates of emigration. More than 20 % of the North Macedonian population have emigrated since 1994, mostly to the EU. As a member of the EU, North Macedonia will enjoy free movement of labour which will make it easy for its citizens to live and work in other EU countries.

Text B — North Macedonia’s economic reforms

- To be considered for EU membership, North Macedonia implemented a series of supply-side policies to reform its economy. The EU imposes strict requirements for membership but provides financial assistance to countries preparing for membership. North Macedonia has received 633 million euros (the currency of the EU) to help with the reforms.

- Most of the supply-side policies seek to improve the international competitiveness of North Macedonia’s industries. The authorities are increasing access to education and training for workers. The expansion of the transport network and other infrastructure is also expected to increase efficiency.

- Protection of the environment is also on the list of requirements for EU membership. North Macedonia aims to reduce its dependence on coal and to instead promote the use of solar, wind and hydropower technologies. These low-carbon energy sources would help decrease its air pollution, which is among the worst in Europe.

- The reforms, which started in 2014, have shown progress. Exports and manufacturing output are more diversified and more concentrated on high-value products. To attract FDI, North Macedonia maintains one of the lowest tax rates on corporate income in the region. The central bank also prevents the denar (North Macedonia’s currency) from appreciating against the euro through managing foreign reserves. However, skill shortages and a mismatch of skills with those required by companies discourage foreign firms from investing. Important investment gaps in public infrastructure also remain.

Text C — North Macedonia’s trade agreements

North Macedonia participates in five free trade agreements (FTAs), that together cover 95 % of its exports and 78 % of its imports. Most of its trade with the EU is already free but imports of wine, beef and fish products are still subject to quotas. North Macedonia is currently a net importer of agricultural and food products. All protectionist measures on EU products would be removed upon entry into the common market.

Question

Using information from Text A, paragraph [4], calculate North Macedonia’s balance of trade in 2018.

▶️Answer/Explanation

7.57 − 9.56

= −(US)\($\)1.99 billion

Text D — Overview of Sierra Leone

- Sierra Leone is located on the west coast of Africa. Economic activity is concentrated on agriculture and mining, which together contribute 70 % of gross domestic product (GDP) and 77 % of export revenue.

- Economic growth rates fluctuated from +20.1 % in 2013 to −21.5 % in 2015. The economic slowdown in China contributed to a significant drop in mining activities and a fall in Sierra Leone’s export revenue. China is Sierra Leone’s largest market for exported minerals.

- Economic growth rates in Sierra Leone have improved in recent years due to increased activity in agriculture, mining and construction. Increased employment in these labour-intensive sectors could help reduce poverty, which remains widespread in the country. Sierra Leone’s ranking in the Inequality adjusted Human Development Index (IHDI) is very low.

- The fall in export revenue has led to a 50 % depreciation of the leone (Sierra Leone’s currency) over the past five years. Even recent increases in the price of commodities have not been sufficient to offset the high import expenditure on food, medication, cars and capital equipment.

- The depreciation of the leone has led to inflationary pressures. The removal of a fuel subsidy resulted in an increase in the price of fuel and pushed the inflation rate from 16.8 % in 2018 to 17.2 % in 2019.

- To make matters worse, access to essential, life-saving health care services in Sierra Leone is often disrupted by regional conflicts. Healthcare in Sierra Leone is generally charged for and is provided by a mixture of government, private and non-governmental organizations (NGOs). NGOs are relied on to protect the health and wellbeing of citizens. NGOs help to achieve this by distributing medicine and teaching families about hygiene and proper sanitation.

- Another area of concern is the government debt, which stood at 62 % of GDP in 2019. The government has reduced its budget deficit from 5.7 % to 3.4 % of GDP by minimizing non-payment of taxes and implementing cost-saving measures such as the automation of some government services.

- The newly elected government has made good progress in its fight against corruption, but it is facing many macroeconomic challenges. Foreign aid has been reduced, infrastructure is inadequate and many economic activities remain untaxed. Youth unemployment is also high due to low literacy rates and a lack of skills required in the job market.

Text E — Sierra Leone’s new development plan

- In 2019, the government of Sierra Leone introduced a new five-year development plan. The plan includes policies aimed at increasing the welfare of Sierra Leone’s citizens by working towards the Sustainable Development Goals.

- The development plan ensures access to free primary and secondary education in all public schools. The cost of education is the main reason that many households are not sending their children, particularly girls, to school. For those paying private education fees, switching to public education would allow more of their household income to be spent on other essential services and farming equipment.

- The expected increase in human capital should facilitate economic activities and lead to investment. Schools now teach modern farming practices, such as those involving the use of farm machinery and fertilizers. These would benefit rice farmers and help achieve food security (ensuring people have access to enough food).

- The provision of technical education should not only increase agricultural output but also allow for the diversification of the economy. The manufacturing sector contributes only 2 % of the country’s GDP and could provide an alternative source of employment. The five-year plan also addresses the lack of infrastructure, in particular for electricity generation, which has so far restricted the development of the manufacturing sector.

Text F — Investment in Sierra Leone

- The World Bank ranked Sierra Leone 160th among 190 countries in 2018 for the ease of doing business, citing difficulties in accessing electricity and in obtaining loans and business permits. Government borrowing from the banking sector has increased in recent years, resulting in high interest rates and limited credit availability for the private sector. Foreign investors, however, usually bring capital from abroad.

- Despite the challenges, Sierra Leone offers significant opportunities for investment. Foreign investors are involved in the energy sector, infrastructure, agriculture, tourism, and natural resources. Reduced tax rates on corporate income are offered for investments in agriculture and tourism.

Question

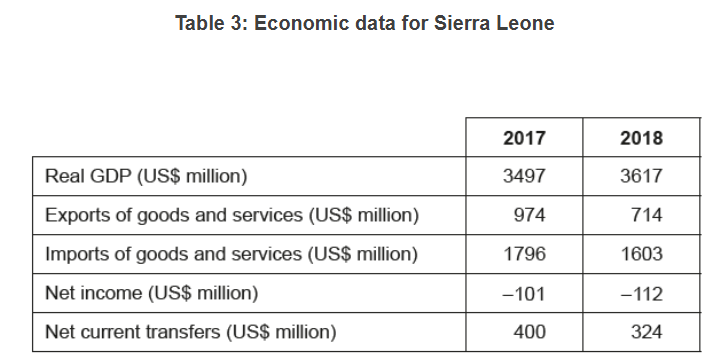

Using the information in Table 3, calculate the change in Sierra Leone’s current account balance from 2017 to 2018.

▶️Answer/Explanation

Current account balance in 2017 = 974 − 1796 − 101 + 400 = –523

Current account balance in 2018 = 714 − 1603 – 112 + 324 = −677

Change = (−677−(−523)) = −(US)\($\)154 million

Text D — Macroeconomic policies in Uruguay

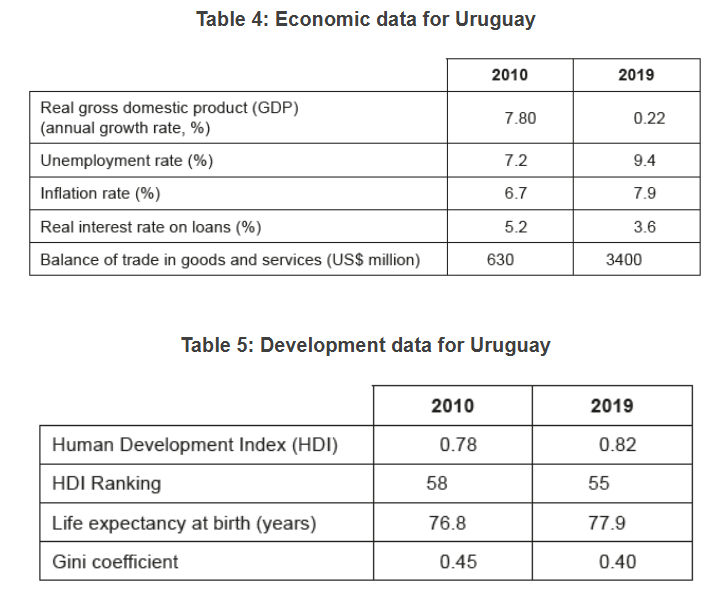

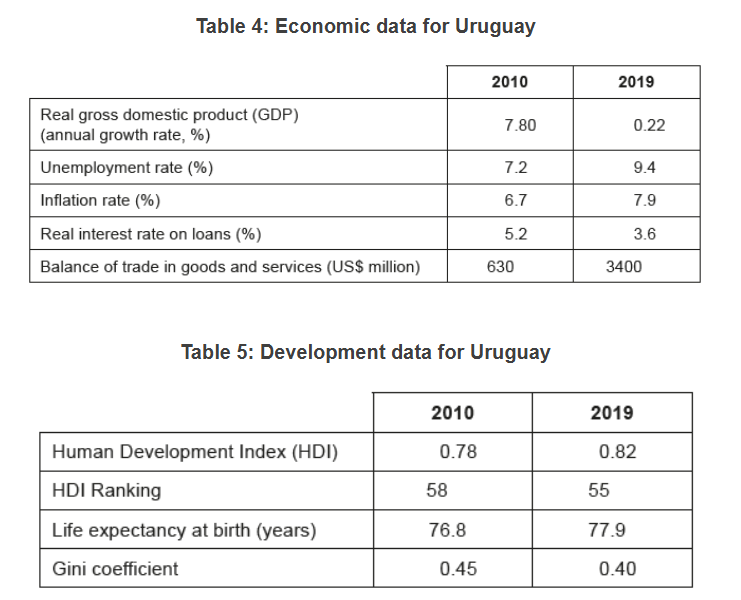

- Compared to many other Latin American countries, Uruguay has a high Human Development Index (HDI). This is due to its higher gross national income (GNI) per capita and wider access to health care and education.

- One aim of Uruguay’s fiscal policy has been income redistribution. For example, in 2017 the tax rate applied to the highest income bracket was raised from 25

% to 36

%. Spending on social programmes, which are targeted towards the poor, has also increased. However, while expenditure on schools is benefitting all families, expenditure on higher education still tends to favour higher-income families, because there are relatively few students from low-income families in universities.

- Recently, concern about a growing budget deficit has led to new budget guidelines being implemented. These guidelines aim to reduce borrowing and the national debt by encouraging the government to increase tax revenue and/or reduce expenditures. The main policy goal of Uruguay’s central bank is to keep a low rate of inflation. It has announced that it will reduce the inflation target to below 6

% by September 2022.

- Several constraints to growth remain, which may limit progress towards sustainable development. Despite plans to upgrade road networks and construct a new central railway, investment in infrastructure needs to be increased further. Education and training could also be improved to meet the needs of new sectors, such as the information and communication technology (ICT) industry.

- State-owned enterprises, including railways and suppliers of fuel, water and electricity, are a significant part of the Uruguayan economy. The prices charged by these enterprises tend to be high relative to prices in other countries. As part of a strategy to eliminate excessive costs, the government has proposed measures to improve efficiency in state-owned enterprises and to gradually reduce prices.

- The International Monetary Fund (IMF) considers that more labour market flexibility is needed to make it easier for workers to change jobs and for firms in growing sectors such as ICT to hire workers. The government is, therefore, considering deregulation of the labour market.

- Overall, by boosting competitiveness and private investment through supply-side policies, the government aims to raise growth and employment.

Text E — Health care system in Uruguay

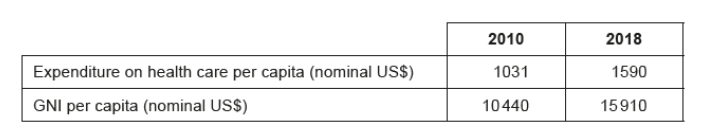

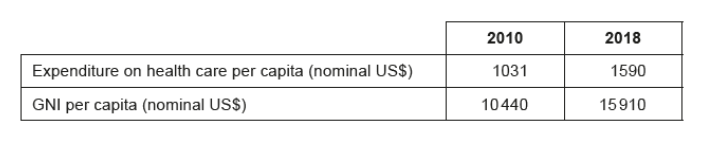

The public and private sectors that offer health care in Uruguay were combined into one system in 2007, with both overseen by the government and both eligible to receive subsidies. Most medical care is free for low-income patients. The first row of data in Table 3 shows that per capita demand for health care increased by 54.22

% from 2010 to 2018. The advantages are seen in longer life expectancy figures, which imply an increase in productivity, and other benefits.

Table 3: Health care expenditure and GNI per capita for Uruguay

Text F — Trade and exchange rates

- Over 50

% of Uruguayan exports are forestry and agricultural goods, including soybeans, rice, and cattle meat. Increasing global demand and a significant rise in commodity prices from 2000 to 2012 encouraged investment in the agricultural sector. However, the price of soybeans has been declining since 2013, partly due to rising productivity in agriculture. Climate-related shocks, such as droughts in 2017 and 2020, and economic crises in the major export markets of Brazil and Argentina have also caused difficulties for producers.

- Therefore, Uruguay aims to diversify its export markets. For example, with the growth of the ICT sector, Montevideo (the capital city of Uruguay) has become a leading software development centre. In addition, Uruguay is broadening its markets towards Europe and Asia. Under a proposed trade agreement between the European Union (EU) and the South American trade bloc, Mercosur (Argentina, Brazil, Paraguay, Venezuela, and Uruguay), 93

% of all tariffs will gradually be eliminated. However, a quota will be imposed on cheese imports from the EU.

- To help the economy adjust to external shocks and to avoid large fluctuations in the exchange rate of the peso (Uruguay’s currency), the central bank uses its plentiful reserve assets of foreign currencies. In 2019, the decline in agricultural export revenues put downward pressure on the peso exchange rate. However, the central bank was able to prevent a large depreciation by using its reserve assets in the foreign exchange market.

Question

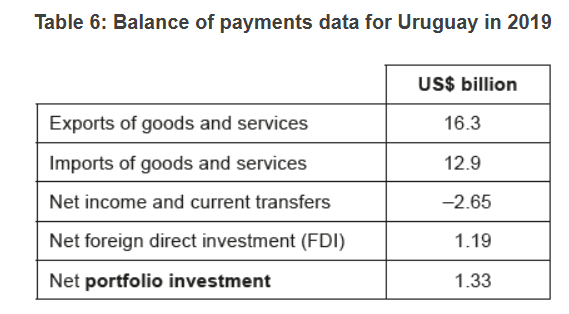

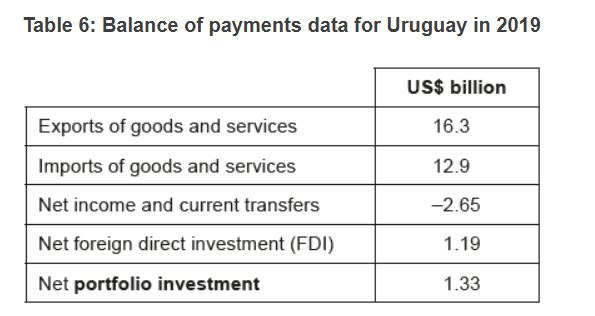

Define the term portfolio investment indicated in bold in Table 6.

▶️Answer/Explanation

An understanding that it is savings and/or the purchase of financial assets/investments (such as shares/bonds/bank deposits) (to gain a return in a given year).

Text D — Macroeconomic policies in Uruguay

- Compared to many other Latin American countries, Uruguay has a high Human Development Index (HDI). This is due to its higher gross national income (GNI) per capita and wider access to health care and education.

- One aim of Uruguay’s fiscal policy has been income redistribution. For example, in 2017 the tax rate applied to the highest income bracket was raised from 25

% to 36

%. Spending on social programmes, which are targeted towards the poor, has also increased. However, while expenditure on schools is benefitting all families, expenditure on higher education still tends to favour higher-income families, because there are relatively few students from low-income families in universities.

- Recently, concern about a growing budget deficit has led to new budget guidelines being implemented. These guidelines aim to reduce borrowing and the national debt by encouraging the government to increase tax revenue and/or reduce expenditures. The main policy goal of Uruguay’s central bank is to keep a low rate of inflation. It has announced that it will reduce the inflation target to below 6

% by September 2022.

- Several constraints to growth remain, which may limit progress towards sustainable development. Despite plans to upgrade road networks and construct a new central railway, investment in infrastructure needs to be increased further. Education and training could also be improved to meet the needs of new sectors, such as the information and communication technology (ICT) industry.

- State-owned enterprises, including railways and suppliers of fuel, water and electricity, are a significant part of the Uruguayan economy. The prices charged by these enterprises tend to be high relative to prices in other countries. As part of a strategy to eliminate excessive costs, the government has proposed measures to improve efficiency in state-owned enterprises and to gradually reduce prices.

- The International Monetary Fund (IMF) considers that more labour market flexibility is needed to make it easier for workers to change jobs and for firms in growing sectors such as ICT to hire workers. The government is, therefore, considering deregulation of the labour market.

- Overall, by boosting competitiveness and private investment through supply-side policies, the government aims to raise growth and employment.

Text E — Health care system in Uruguay

The public and private sectors that offer health care in Uruguay were combined into one system in 2007, with both overseen by the government and both eligible to receive subsidies. Most medical care is free for low-income patients. The first row of data in Table 3 shows that per capita demand for health care increased by 54.22

% from 2010 to 2018. The advantages are seen in longer life expectancy figures, which imply an increase in productivity, and other benefits.

Table 3: Health care expenditure and GNI per capita for Uruguay

Text F — Trade and exchange rates

- Over 50

% of Uruguayan exports are forestry and agricultural goods, including soybeans, rice, and cattle meat. Increasing global demand and a significant rise in commodity prices from 2000 to 2012 encouraged investment in the agricultural sector. However, the price of soybeans has been declining since 2013, partly due to rising productivity in agriculture. Climate-related shocks, such as droughts in 2017 and 2020, and economic crises in the major export markets of Brazil and Argentina have also caused difficulties for producers.

- Therefore, Uruguay aims to diversify its export markets. For example, with the growth of the ICT sector, Montevideo (the capital city of Uruguay) has become a leading software development centre. In addition, Uruguay is broadening its markets towards Europe and Asia. Under a proposed trade agreement between the European Union (EU) and the South American trade bloc, Mercosur (Argentina, Brazil, Paraguay, Venezuela, and Uruguay), 93

% of all tariffs will gradually be eliminated. However, a quota will be imposed on cheese imports from the EU.

- To help the economy adjust to external shocks and to avoid large fluctuations in the exchange rate of the peso (Uruguay’s currency), the central bank uses its plentiful reserve assets of foreign currencies. In 2019, the decline in agricultural export revenues put downward pressure on the peso exchange rate. However, the central bank was able to prevent a large depreciation by using its reserve assets in the foreign exchange market.

Question

Using information from Table 6, calculate the current account balance in 2019.

▶️Answer/Explanation

16.3-12.9 -2.65 = 0.75

Balance = (US)\($\) 0.75 billion OR (US)\($\) 750 million

Question

Using information from Table 1, calculate the change in Uruguay’s current account balance between 2018 and 2019.

▶️Answer/Explanation

Current account in 2019:

(18.52 – 17.88) – 3.05 + 0.19 = -2.22

Question

Using information from Table 1, state whether Uruguay is facing a deficit or a surplus in its balance of trade in goods and services in 2019.

▶️Answer/Explanation

The balance of trade is in surplus