IBDP Economics HL – Macroeconomics – Variations in economic activity—aggregate demand and aggregate supply -Paper 2 Exam Style Practice Questions

Variations in economic activity—aggregate demand and aggregate supply Paper 2?

Exam Style Questions..

Subject Guide IBDP Economic IBO

IBDP Economic SL- All Topics

Exam Style Question for IBDP Economics HL- Variations in economic activity—aggregate demand and aggregate supply -Paper 2

The World Bank reports on economic growth in Kenya

- The World Bank’s recent overview of Kenya has given a positive assessment of Kenya’s growth prospects, based on domestic and international factors. The East African nation of Kenya has a population of approximately 46.1 million, which increases by an estimated one million per year. The World Bank projected 5.9 % economic growth in 2016, rising to 6 % in 2017. This positive outlook is based on continued low oil prices, growth in the agricultural sector, expansionary monetary policy and ongoing infrastructure investments.

- The World Bank has identified other key contributing factors to Kenya’s short-term growth. These include an expanding services sector, higher levels of construction, currency stability, low inflation, a growing middle-class and rising incomes, a surge in remittances (money sent by a foreign worker to their home country) and increased public investment in energy and transportation.

- Tourism, information and communications and public administration are among the sectors that have registered the highest growth. Inflation has been at an average of 6.3 %, which is within the Kenyan central bank’s target range.

- The World Bank also predicted that, of 82 countries investigated, Kenya would have the highest long-term growth and that its real gross domestic product (GDP) in 2050 should be seven times larger than it is today. Fast population growth, a modest improvement in the business environment, urbanization and fast-growing neighbouring countries are all contributing factors to the positive prediction.

- While the growing Kenyan economy is creating more jobs now than in the past, these are mainly in the informal services sector and are low productivity jobs. 9 million young people will join the labour market in the next 10 years. Given the scarcity of formal sector jobs, they will continue to find jobs in the informal sector. These jobs are usually in very small businesses, often run from homes.

- The World Bank suggests that there is a need to increase the productivity of jobs in the informal sector. It says that this could be achieved by increasing work-related skills through training schemes, increasing communication and learning between formal and informal firms, and helping small-scale firms to become suppliers for firms in the formal sector. To create more and higher-skilled jobs, it is also essential to reduce the cost of doing business.

- According to the World Bank, Kenya has made significant structural and economic reforms that have contributed to sustained economic growth in the past decade. However, economic growth does not always mean economic development. The main development challenges facing Kenya include poverty, inequality, climate change, low commodity prices and the vulnerability of the economy to internal and external shocks.

Question

Define the term investment indicated in bold in the text (paragraph [2]).

▶️Answer/Explanation

- any addition to the capital stock of the economy OR

- expenditure by firms on capital OR

- public investment (context of paragraph) is expenditure by government on capital.

Filipino rice farmers prepare for trade liberalization

- To meet its obligations under World Trade Organization (WTO) rules, the president of the Philippines has asked the government to eliminate the current quota system for rice imports. As an important part of food security measures, the government wants to achieve self-sufficiency in the production of rice. To support this goal, the WTO allowed the Philippines to extend its rice quota until June 2017 to allow more time for local farmers to prepare for free trade.

- The current quota system for rice imports makes domestic prices rise dramatically during periods of low domestic supply.

- Eliminating the quota on rice aims to make the rice market more competitive, which could reduce the price of rice by as much as 7 Philippine pesos (PH₱) per kilogram (kg). The National Economic and Development Authority has estimated that lower rice prices could save Filipino households as much as PH₱2362 per year. However, if the rice quota is eliminated, economists have warned that the government must prepare local rice producers so that they can either compete with rice imports or move to producing other crops. “Currently Filipino farmers cannot compete with Vietnamese farmers who may enjoy economies of scale” declared one economist. “The solution is to bring down the cost of production of rice.”

- To help Filipino farmers to adjust to competition from lower-priced rice imports, the government has allocated funds to the Rice Competitiveness Enhancement Fund. This fund will provide support to farmers in order to increase productivity by supplying high-yield seeds and fertilizer. It will also provide subsidies to encourage the use of agricultural machinery and will offer support services and training to farmers.

- Apart from being an essential food for many Filipinos, rice is also an important input for the food industry. The plan to remove the import quota will reduce the inflation rate in the Philippines by up to 0.4 %. In July 2018, the central bank governor reported that inflation had reached 5.7 %, well above the government’s target range of 2 % to 4 %. He stated that “supply-side factors are the main drivers of the present inflation. These factors include rising international oil prices, higher indirect taxes and poor weather conditions that have affected food supply”. The president stated that the removal of the rice quota was one solution to ease the rising inflation.

Question

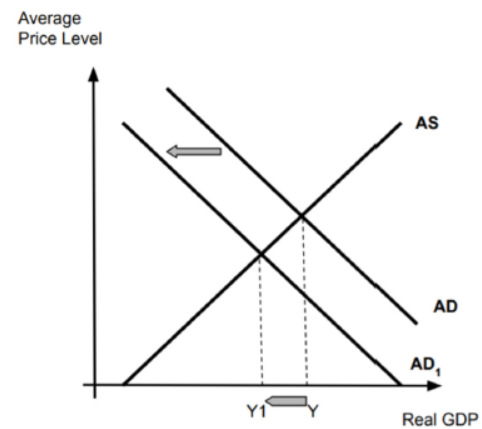

Using an AD/AS diagram, explain how removing “the import quota will reduce the inflation rate in the Philippines” (paragraph [5]).

▶️Answer/Explanation

AND

an explanation that removing the quota will decrease the price of rice, this will increase AS due to decreased costs of production leading to a decrease in the price level, reducing the inflation rate.

Trade war with the United States puts pressure on China’s currency

- As a trade war between the United States (US) and China worsens, a central bank official has said that China will not use its currency to deal with trade conflicts and will continue with the market-based reforms of its exchange rate system. In the past, the US has accused China of being a currency manipulator that has maintained a fixed exchange rate to keep the renminbi (RMB, China’s currency) undervalued. According to a US trade official, “a depreciating currency is good for the Chinese economy”.

- The value of the renminbi has fallen 9 % against the US dollar (US$) in the past six months. Expansionary domestic monetary policy, concerns about economic growth and an escalating trade war continue to put downward pressure on the renminbi. Allowing the value of the renminbi to fall suggests that the central bank is currently maintaining a managed exchange rate rather than a fixed peg to the US dollar.

- The cause of the lower value of the renminbi—aside from a slowdown in Chinese economic growth—is a shrinking current account surplus. The US has imposed tariffs on US$250 billion worth of Chinese imports. The US president has also threatened to impose tariffs on the remaining imports from China. This, along with a widening trade deficit in services, caused mainly by the rise in Chinese tourists travelling abroad, would further reduce China’s current account surplus. In 2017, China’s current account surplus was 1.6 % of gross domestic product (GDP). By the first quarter of 2018, the surplus became a small deficit.

- There is international concern about the potential damage that a prolonged trade war with the US could cause to the Chinese economy. Central bank officials in China are concerned about the depreciating currency but are trying to avoid central bank intervention. To support the export sector, the Chinese government is considering measures such as subsidies and exemptions from some indirect taxes. These measures, along with a falling renminbi will allow Chinese exporters to avoid passing on some of the tariff costs to US consumers.

- To complicate matters for China, economic growth in the US is causing US interest rates to rise and the US dollar to strengthen. This, along with China’s first current account deficit in 20 years, is negatively affecting China’s financial account. Responding to the rising US interest rates with increases of its own is not a good option for China’s central bank, because Chinese companies have a heavy debt burden that is slowing economic growth. Recently, a government official advised against increasing China’s interest rate because of its impact on borrowing costs in China.

Question

Using an AD/AS diagram, explain how “increasing China’s interest rate” could affect its economic growth (paragraph [5]).

▶️Answer/Explanation

AND

for an explanation that a rise in interest rates may cause an increase in borrowing costs leading to a decrease in the consumption or investment components of aggregate demand, thus bringing about a decrease in real GDP (growth).

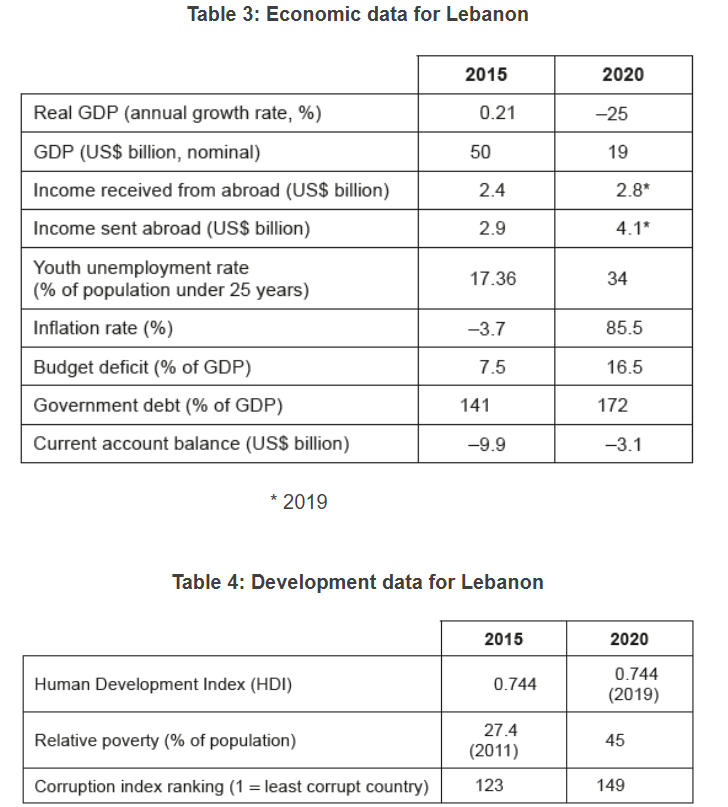

Text D — Overview of Lebanon

- Lebanon is in the Middle East, bordering the Mediterranean Sea, and is home to nearly 7 million people. Lebanon is in an economic crisis, facing a recession, huge government debt and rising income inequality, poverty and inflation. Corruption and poor governance have been blamed for misallocation of funds that has led to low levels of investment and extensive capital flight. Additionally, Lebanon has one of the most unequal distributions of wealth in the world. In 2019, the top 10% of income earners owned over 70% of personal wealth in Lebanon.

- Infrastructure in Lebanon is poor, water and sewerage systems are basic, and roads are inadequate. Electricity supply is unreliable with people going without power for much of the day. In 2020, major buildings including food storage buildings, schools and hospitals were damaged in Beirut (the capital city of Lebanon). This was concerning as 85% of the country’s food arrives through Beirut. Fortunately, humanitarian aid was given by the international community to help rebuild the damaged buildings.

- Despite a history of inflows from luxury tourism and remittances (money sent by a foreign worker to their home country), there is a persistent current account deficit. To help with this, the Lebanese central bank has used high interest rates to attract financial inflows. Additionally, the government has borrowed funds from overseas. However, the misuse of these funds and overspending have contributed to one of the highest foreign debts in the world. Lebanon recently defaulted on foreign debt repayments worth 1.2 billion euros, which damaged its international credit rating, making it difficult to access loans needed to help solve its current economic problems.

Text E — Further challenges facing Lebanon

- Social unrest is prevalent and intensified when the government suggested raising revenue by imposing an indirect tax on social media applications such as WhatsApp. As the government struggles to pay its debts, people are concerned that subsidies on necessities such as wheat, medicine and fuel will be removed.

- Mismanagement of the state-run electricity and telecommunications sectors has resulted in unreliable services and high telecommunication prices. The state-run monopoly firms make losses, and the electricity sector relies heavily on government subsidies, putting pressure on the budget deficit.

- Lebanon currently has a managed exchange rate system with the Lebanese pound (Lebanon’s currency) linked to the US dollar (US$). However, the government is finding it difficult to maintain the exchange rate at the desired level due to insufficient reserve assets. Recent falling remittances, low levels of exports and lack of foreign direct investment (FDI) are placing downward pressure on the Lebanese pound. Lebanon has limited natural resources and a small manufacturing industry, thus relies heavily on imports. As a consequence, the gradual depreciation of the Lebanese pound has led to cost-push inflation.

Text F — Reforms and strategies for economic recovery

- The Lebanese government is seeking help from the International Monetary Fund (IMF) to restructure the government debt and develop its infrastructure. However, loans from the IMF will require the following conditions to be met:

- procedures and processes established to ensure good governance, including enforcement of anti-corruption laws

- financial sector reforms implemented to build confidence in the banking system and laws to control capital flight

- government spending reduced and revenue increased through higher corporate, wealth and personal income taxes for high-income earners. Introduction of a tax on imported luxury goods and an increase of indirect taxes

- partially privatizing the electricity and telecommunications sectors to increase efficiency and encourage the exploration of new energy sources

- transitioning from a managed to a floating exchange rate system.

- Other organizations are offering development aid to rebuild infrastructure and support small to medium-sized businesses to develop the manufacturing sector and attract FDI. Currently, the manufacturing sector accounts for only 12.5% of gross domestic product (GDP). Some experts recommend that Lebanon decreases its reliance on food imports by developing its own food industry. However, Lebanon must commit to establishing good governance systems before aid organizations will provide their support.

- Lebanon has resisted seeking help from the IMF and other agencies in the past due to concerns about high levels of interference and imposed conditions that may conflict with their own government objectives.

Question

Using an AD/AS diagram, explain how falling remittances may affect Lebanon’s real output (Text E, paragraph [3]).

▶️Answer/Explanation

AND

for an explanation that a rise in interest rates may cause an increase in borrowing costs leading to a decrease in the consumption or investment components of aggregate demand, thus bringing about a decrease in real GDP (growth).