IBDP Economics HL – Microeconomics – Role of government in microeconomic -Paper 2 Exam Style Practice Questions

Role of government in microeconomic Paper 2?

Exam Style Questions.

Subject Guide IBDP Economic IBO

IBDP Economic SL- All Topics

Exam Style Question for IBDP Economics HL- Role of government in microeconomic -Paper 2

Economic growth in Cambodia

- Economic growth in Cambodia Cambodia has become one of the fastest growing economies in Asia and has now been classified as an upper middle-income country, according to the World Bank.

- Export promotion has helped Cambodia to grow. It has used low-cost labour to manufacture products for export. This has been helped by the fact that the price of labour has increased in China and other Asian countries. Cambodia’s large supply of inexpensive, low-skilled labour has attracted much foreign direct investment (FDI) into the production of garments and footwear for export and contributed to its economic growth. Last year, there was a 10.2 % increase in the export of garments and footwear in Cambodia, which makes up 70 % of its exports.

- Throughout Asia, hundreds of millions of people have been lifted out of poverty through manufacturing jobs that allowed them to better educate their children, who could then have a better life.

- However, Cambodia’s manufacturing competitiveness is being challenged by other countries in the region, particularly those that manufacture low-cost clothing. A recent increase in the minimum wage may also pose problems. Industry representatives have raised concerns that the garment industry may lose investors, who may leave to find cheaper places, if the minimum wage continues to increase.

- Cambodia needs to further diversify its economy if it hopes to maintain the high growth rates it has achieved in recent years. To support diversification, the government has launched an industrial development policy aimed at upgrading industry from low-cost, labour-intensive manufacturing to production with higher value added. The policy encourages the expansion and modernization of small and medium-sized enterprises, stronger regulations and enforcement, and a better environment for doing business.

- There remain many challenges to deal with. One of them is growing inequality—there is income inequality between urban and rural areas—as well as gender inequality. Women continue to face disadvantages in gaining access to higher education, well-paid employment opportunities and decision-making roles in government.

- Approximately 30 000 young Cambodians enter the labour force each year but often do not have the required skills to meet the needs of the labour market. While a large proportion of the labour force is employed, many jobs are informal, vulnerable, unstable and poorly paid. There is a critical need to address problems in education and training and to help children complete school. While 98 % of children attend primary school in Cambodia, many drop out later due to a lack of funds. Only 30 % of young people complete high school.

- The rapid economic and population growth in Cambodia is leading to significant environmental pollution. Environmentalists have identified garment factories as being one of the four main industrial activities that significantly contribute to air and water pollution.

Question

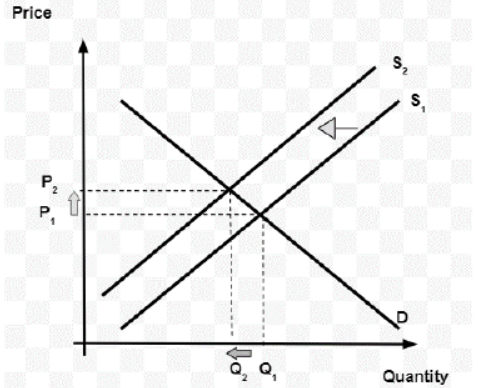

Using a demand and supply diagram, explain why the increase in the minimum wage might affect Cambodia’s garment manufacturing competitiveness against other countries in the region (paragraph [4]).

▶️Answer/Explanation

an explanation that the increase in the minimum wage increases the cost of production for garment producers, resulting in a fall in supply and an increase in the price of Cambodian garments, thus making them less competitive against other countries in the region.

Changing times for Vanuatu

- Vanuatu is an island nation in the west of the Pacific Ocean. The islands are isolated with 80 % of the population living in rural villages as subsistence farmers. In recent years, Vanuatu has experienced strong economic growth driven by tourism, construction and foreign aid. However, Vanuatu has a United Nations (UN) status as the world’s most vulnerable country to natural disasters, and this vulnerability is intensified through climate change. Furthermore, economic development in Vanuatu is constrained by lack of education, limited public sector capacity, poor infrastructure and low labour market participation rates of women and youth.

- Vanuatu currently faces growing income disparities between rural and urban areas. The poverty rate is currently at 3.8 % in the rural areas and 10.4 % in Port Vila, the capital city. Urbanization has led to large numbers of unskilled low-income workers concentrated in informal sectors in Port Vila. As a result, there is a shortage of housing, water and electricity services.

- The UN categorizes Vanuatu as a Least Developed Country, but it will be moving to the higher category of Developing Country by the end of 2020. This will mean that some special assistance such as access to development finance, trade and market access, and technology transfer will be slowly withdrawn. However, there will be benefits for Vanuatu as it will gain greater access to commercial lenders, foreign direct investment (FDI) and climate finance funds.

- To help with the transition to the new UN category, Australia and New Zealand are continuing aid projects to improve public sector capacity, increase economic participation of women and youth and improve access to electricity in Vanuatu. Moreover, Japan and China have significantly increased aid through grants and concessional loans. China is now the leading donor to Vanuatu.

- The Vanuatu government has targeted the development of human capital through education, healthcare and infrastructure. Most of the aid from China has been used to develop new airports and shipping ports. This infrastructure will further help producers to access export markets and gain economies of scale. However, government institutions need to be improved so that the benefits of export revenues are redistributed to those in need. Historically, the lack of good governance has led to misuse of funds.

- Economists believe the foreign aid spending could help attract FDI, which is important to help Vanuatu develop export markets in organic beef, sandalwood oil, tamanu oil and canarium nuts to provide areas for growth. Historically, growth was driven through import substitution by subsidizing manufacturing industries.

- Vanuatu is currently reforming the tax system to lower the reliance on indirect taxes and implementing a progressive tax system to increase government revenue. The increased tax revenue will also decrease Vanuatu’s dependence on foreign aid.

Question

Using a demand and supply diagram, explain how a subsidy changes the consumer surplus for a good (paragraph [6]).

▶️Answer/Explanation

For drawing a correctly labelled demand and supply diagram showing a supply shift to the right, a price decrease and identification / appropriate annotation that indicates an increase in consumer surplus

AND

For explaining that a subsidy increases the supply as costs of production decrease, price will decrease, and consumer surplus will increase.

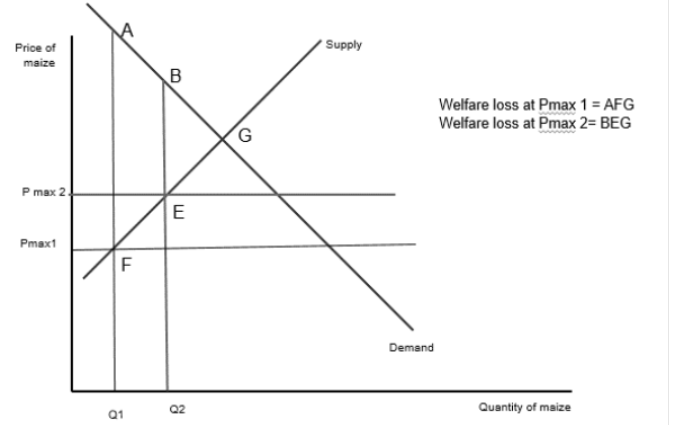

Text D — Overview of Malawi

- Malawi is a landlocked country in southern Africa. Its development plans contain 169 targets, based on the Sustainable Development Goals. Ineffective institutions and inequalities, however, make it difficult to reach every target. Although poverty in urban areas has declined, the level of absolute poverty has been increasing in rural areas where 85 % of the population lives. Causes of poverty include land degradation (80 % of the land is eroded or lacks nutrients), poor healthcare and rapid population growth. There is also a lack of human capital, which is often due to the difficulties that households have in obtaining loans for education or training. Approximately 75 % of households do not have access to formal banking services.

- Aid agencies are providing assistance. The World Bank’s Human Capital Project will increase investment and encourage reforms, such as promoting the education of teenage girls. In 2020, the World Bank also approved US\($\)157 million (50 % as a loan and 50 % as a grant) for a government project. This project aims to increase sustainable land management practices and build water-related infrastructure, such as small dams and irrigation schemes.

- The government has encouraged the establishment of microfinance groups that act as rural banks. They provide some finance and guidance for programmes that introduce new types of crops and techniques in order to improve agricultural efficiency.

- Although 2019 was a difficult year due to drought, insect infestations, and a tropical cyclone, Malawi’s real gross domestic product (GDP) grew by 4.5 %. There is a large budget deficit and the amount of government debt (at approximately 60 % of GDP) is considered to be too high. Therefore, the government has announced plans to reduce its spending. Inflation had been forecast to increase to 14 % in 2020. Due to the planned contractionary fiscal policies, however, inflation may fall below 10 % from 2021 onwards.

- Export revenues account for over 30 % of GDP. Malawi aims to increase its exports of cotton, nuts, tea and sugar. Rising exports and lower fuel import prices could reduce the current account deficit. Despite the persistent trade deficit, Malawi is resisting calls for further trade protection. It has signed bilateral trade agreements with both South Africa and Zimbabwe. Tariffs are gradually being reduced, while other indirect and direct taxes are being raised.

Text E — Agricultural Production

- Approximately 80 % of the labour force is employed in agriculture, with few job opportunities available in manufacturing and services. Agricultural productivity is low for many reasons. The government promotes manufacturing industries and cultivation of crops for export by large-scale farms. However, small-scale and subsistence farmers have received little support in the past. Farmers use less fertilizer and irrigation than is typical in other countries. Only 3 % of cultivated land is irrigated, compared to the global average of 21 %. Other challenges are the inadequate road and rail links to markets and the limited availability of electricity and fuel.

- Maize is the most important staple food in Malawi. The government uses price controls when trying to ensure that maize is available at affordable prices for low-income households. However, the maximum price set by the government is often too low to persuade farmers to supply the maize or to provide them with sufficient revenue. In 2020, the maximum price was raised from 250 to 310 kwacha per kilogram. Even at the higher price, shortages remain.

- The government is planning to invest in commercial agriculture to improve productivity and promote diversification. The 2020 budget includes subsidies on fertilizer for 4.3 million small-scale farmers, which could possibly double maize output but may also pollute waterways. The support given to farmers will improve the nutrition of Malawians and stimulate the rural economy.

Text F — Tobacco Exports

Tobacco is Malawi’s major export, providing over 50 % of foreign currency earnings. Due to lower global demand and the purchasing policies of multinational tobacco firms, prices paid to farmers in Malawi are low and falling. To reduce costs, farmers resort to using child labour. Following allegations of labour exploitation, the United States has restricted tobacco imports from Malawi. There is concern that other importing countries might also impose restrictions.

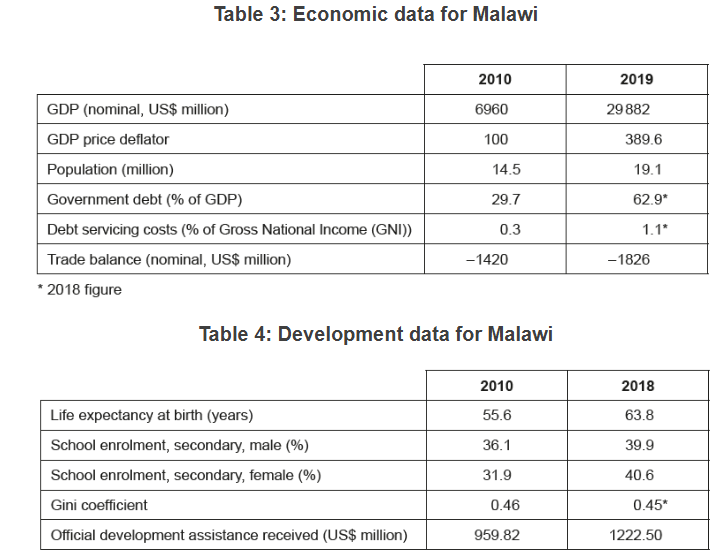

Question

Using a demand and supply diagram, explain how the rise in the maximum price of maize would change the welfare loss associated with the maximum price (Text E, paragraph [2]).

▶️Answer/Explanation

For a demand and supply diagram, with a maximum price below the equilibrium, which is raised to another maximum price (which is still below the equilibrium) with the reduction in welfare loss shown

AND

for an explanation that when the maximum price is raised, the welfare loss is lower [1] because (one of the following is sufficient ):

- quantity supplied increases and quantity demanded decreases

- the market is closer to the optimum/equilibrium

- there is a decrease in excess demand/ the shortage is reduced

- there is a more efficient allocation of resources.

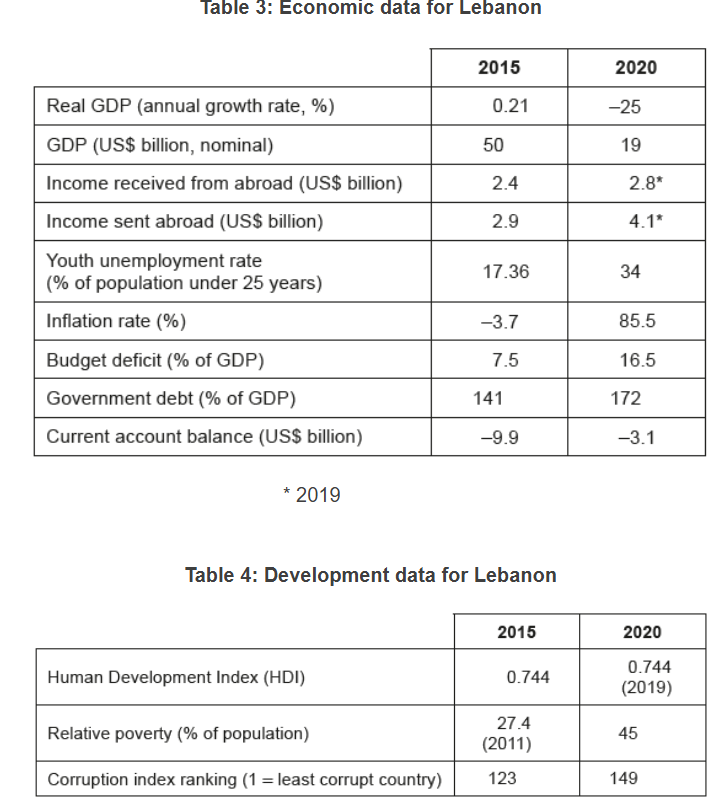

Text D — Overview of Lebanon

- Lebanon is in the Middle East, bordering the Mediterranean Sea, and is home to nearly 7 million people. Lebanon is in an economic crisis, facing a recession, huge government debt and rising income inequality, poverty and inflation. Corruption and poor governance have been blamed for misallocation of funds that has led to low levels of investment and extensive capital flight. Additionally, Lebanon has one of the most unequal distributions of wealth in the world. In 2019, the top 10% of income earners owned over 70% of personal wealth in Lebanon.

- Infrastructure in Lebanon is poor, water and sewerage systems are basic, and roads are inadequate. Electricity supply is unreliable with people going without power for much of the day. In 2020, major buildings including food storage buildings, schools and hospitals were damaged in Beirut (the capital city of Lebanon). This was concerning as 85% of the country’s food arrives through Beirut. Fortunately, humanitarian aid was given by the international community to help rebuild the damaged buildings.

- Despite a history of inflows from luxury tourism and remittances (money sent by a foreign worker to their home country), there is a persistent current account deficit. To help with this, the Lebanese central bank has used high interest rates to attract financial inflows. Additionally, the government has borrowed funds from overseas. However, the misuse of these funds and overspending have contributed to one of the highest foreign debts in the world. Lebanon recently defaulted on foreign debt repayments worth 1.2 billion euros, which damaged its international credit rating, making it difficult to access loans needed to help solve its current economic problems.

Text E — Further challenges facing Lebanon

- Social unrest is prevalent and intensified when the government suggested raising revenue by imposing an indirect tax on social media applications such as WhatsApp. As the government struggles to pay its debts, people are concerned that subsidies on necessities such as wheat, medicine and fuel will be removed.

- Mismanagement of the state-run electricity and telecommunications sectors has resulted in unreliable services and high telecommunication prices. The state-run monopoly firms make losses, and the electricity sector relies heavily on government subsidies, putting pressure on the budget deficit.

- Lebanon currently has a managed exchange rate system with the Lebanese pound (Lebanon’s currency) linked to the US dollar (US$). However, the government is finding it difficult to maintain the exchange rate at the desired level due to insufficient reserve assets. Recent falling remittances, low levels of exports and lack of foreign direct investment (FDI) are placing downward pressure on the Lebanese pound. Lebanon has limited natural resources and a small manufacturing industry, thus relies heavily on imports. As a consequence, the gradual depreciation of the Lebanese pound has led to cost-push inflation.

Text F — Reforms and strategies for economic recovery

- The Lebanese government is seeking help from the International Monetary Fund (IMF) to restructure the government debt and develop its infrastructure. However, loans from the IMF will require the following conditions to be met:

- procedures and processes established to ensure good governance, including enforcement of anti-corruption laws

- financial sector reforms implemented to build confidence in the banking system and laws to control capital flight

- government spending reduced and revenue increased through higher corporate, wealth and personal income taxes for high-income earners. Introduction of a tax on imported luxury goods and an increase of indirect taxes

- partially privatizing the electricity and telecommunications sectors to increase efficiency and encourage the exploration of new energy sources

- transitioning from a managed to a floating exchange rate system.

- Other organizations are offering development aid to rebuild infrastructure and support small to medium-sized businesses to develop the manufacturing sector and attract FDI. Currently, the manufacturing sector accounts for only 12.5% of gross domestic product (GDP). Some experts recommend that Lebanon decreases its reliance on food imports by developing its own food industry. However, Lebanon must commit to establishing good governance systems before aid organizations will provide their support.

- Lebanon has resisted seeking help from the IMF and other agencies in the past due to concerns about high levels of interference and imposed conditions that may conflict with their own government objectives.

Question

Sketch a demand and supply diagram to show the impact of an indirect tax on the market for social media applications such as WhatsApp (Text E, paragraph [1]).

▶️Answer/Explanation

For drawing a correctly labelled demand and supply diagram curve showing a decrease in supply/shift to the left